The Future of Auditing: What to Look for in 2025

The 2025 audit landscape is shaped by new regulations and changes in enforcement of existing regulations. In the United States, both changes to longstanding administrative law and the Public Company Accounting Oversight Board (PCAOB) will shape regulations. Despite Federal changes, new regulations like California’s new climate reporting laws will require companies to undergo audits for their preparedness for climate and sustainability-related disclosure requirements.

In the European Union, the NIS2 Directive will impose cybersecurity control and reporting obligations in critical industries. Digital Operational Resilience Act (DORA) will require financial institutions to comply with new operational resilience standards and cybersecurity controls, which will affect audit processes. And the EU may lean into their harmonized anti-corruption directive, which will increase regulatory scrutiny, in response to the United States’ recent enforcement shift of the Foreign Corrupt Practices Act (FCPA).

By embracing these changes, GRC professionals, cybersecurity experts, and internal audit committees can better align their practices with broader business objectives, ultimately enhancing their ability to respond to the dynamic regulatory landscape and technological advancements.

Keep reading to learn what’s new, what’s changing, and how to successfully navigate auditing this year and beyond.

The impact of AI and cloud technology on auditing

Integrating AI and cloud technology is reshaping auditing processes, requiring GRC and cybersecurity professionals to adapt to new tools that centralize risk and compliance activities. This shift improves efficiency and accuracy in audits, allowing for real-time monitoring and streamlined workflows. Companies increasingly use AI-driven solutions to automate routine tasks, such as data analysis and cybersecurity anomaly detection, freeing up professionals to focus on more complex issues. Globally, auditors are expected to implement AI tools for tasks like sampling, risk identification, and data analysis. While this may increase audit efficiencies, audit clients are likely to ask for cost concessions. And PCAOB rule 3502, which introduces personal liability for auditors, will likely create challenges in attracting and retaining talent at audit firms.

Adapting to these new challenges and opportunities in auditing requires a proactive approach to compliance management. AI’s growing popularity introduces both risks and opportunities, prompting audit committees to clarify their roles in overseeing AI, cybersecurity, and data governance. This ensures that internal controls and risk management processes are robust and effective.

Organizations are shifting to testing all controls rather than only the most critical ones, which reflects a shift towards operational excellence and strategic growth. In fact, we have the data to back this claim up: Hyperproof’s 2025 IT and Risk Compliance Benchmark Report found that 59% of respondents test all controls instead of only the most critical controls, an increase of 26% year-over-year in the number of organizations testing all controls.

Take a deeper dive into how AI will impact the future of auditing in this episode of Drafting Compliance. Kayne and Tom discuss NIS2, DORA, and even FedRAMP, exploring how AI will change managing these frameworks. Plus, you’ll want to watch their beer review at the end to see what Kayne, notorious beer hater, thinks of what they’re drinking this episode.

Regulatory changes and compliance challenges

The twin forces of regulatory change and widespread AI adoption are further testing internal controls over both financial reporting and cybersecurity. New extraterritorial regulations from the EU like DORA and NIS2 are pushing organizations to mature their GRC programs, making compliance a strategic imperative. Domestically, the trend towards deregulation may lead to a patchwork of state-by-state regulations, increasing scrutiny by states’ Attorneys General.

The new administration at the SEC may shift focus from cybersecurity to more traditional financial controls of interest to investors, like forecasting, disclosures, and the impact of these events on liquidity and market stability. These changes require organizations to reassess their internal controls and compliance strategies, which is challenging because of hiring freezes and a shortage of IT professionals.

Regulatory requirements are increasing in complexity, requiring a pivot towards centralized GRC teams and the adoption of automated tools. This approach not only improves efficiency but also reduces the likelihood of data breaches by integrating risk management strategies across the organization.

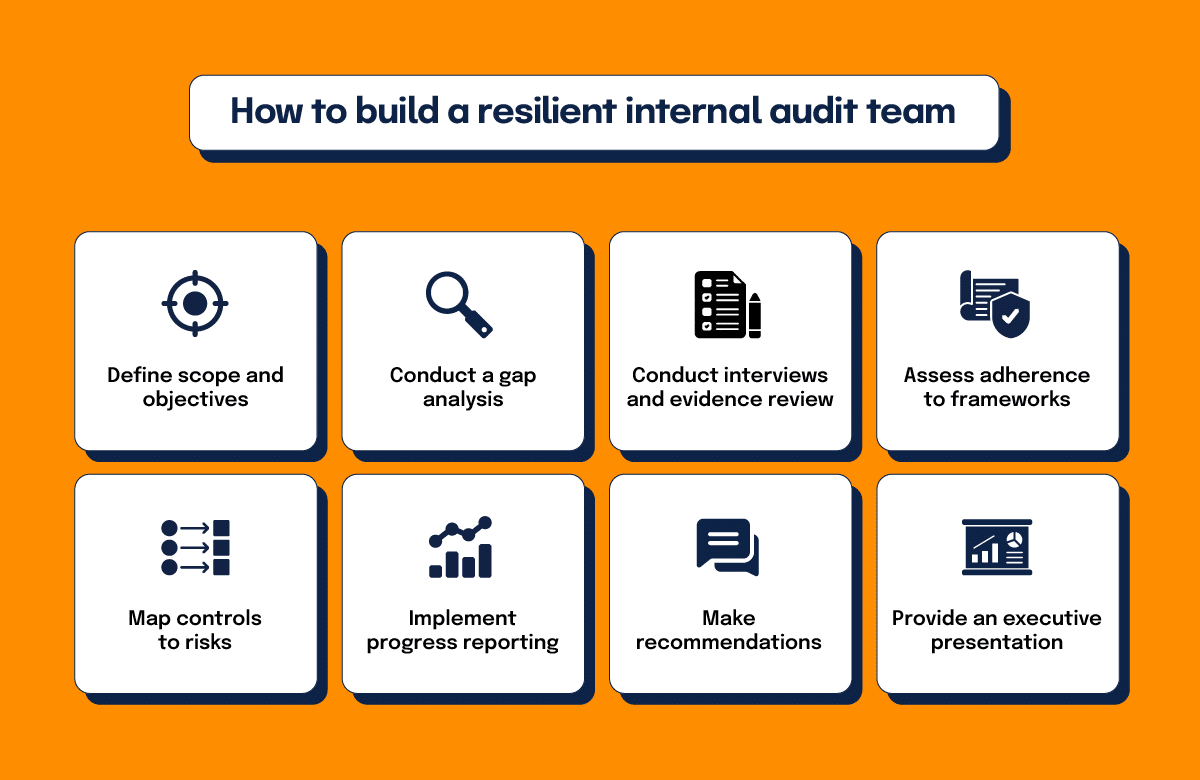

How to build a resilient internal audit team

Organizations can build a resilient internal audit team that can adapt to changing industry demands by prioritizing continuous training and skill development. Ongoing training and certification programs for GRC and cybersecurity professionals keep team members updated with the latest industry standards and practices.

This continuous learning process enhances the internal audit team’s capabilities, making them more adept at handling emerging challenges. Cross-departmental working groups play a crucial role in bridging knowledge gaps and managing operational processes. By bringing together diverse expertise from different departments, these groups ensure a well-rounded approach to cybersecurity and audit tasks.

Unfortunately, there may not be enough professionals to adequately staff internal audit and cybersecurity teams. The World Economic Forum’s Global Cybersecurity Outlook 2025 report shows that 39% of organizations identify skills shortages as a major barrier to resilience, while only 14% have the talent necessary to achieve their cybersecurity goals. The report also notes that the skills gap has widened by 8% from 2024 to 2025, with the public sector particularly affected, as 49% of organizations report lacking the workforce to meet their cybersecurity objectives, a 33% increase from 2024.

Addressing this shortage of skilled IT and audit professionals requires a strategic, blended approach that combines outsourcing and collaboration. By leveraging external specialists and consultants for IT security, asset management, and risk assessments, organizations can fill immediate skill gaps while benefiting from the expertise of seasoned professionals. This approach not only addresses the shortage but also facilitates knowledge transfer, as internal teams work alongside external experts to learn best practices.

For example, consider an organization that wants to reduce cybersecurity risks while maintaining regulatory compliance and external compliance attestations (like ISO 27001) without additional audit burdens. Using of external consultants to conduct a cybersecurity program review will help prepare for multiple audits by including these steps in a request for proposal (RFP):

Define scope and objectives

Clearly define the purpose of the review, focusing on the effectiveness of the cybersecurity program in reducing business risks to tolerable levels, and provide a cohort analysis.

Conduct a gap analysis

Have the consultants perform a gap analysis to find deficiencies between the current cybersecurity posture and the best practices or industry standards among industry peers.

Conduct interviews and evidence review

The consultants should conduct interviews with key control owners and review evidence of control operation to gain insights into control effectiveness.

Assess adherence to frameworks

Review the organization’s effectiveness at implementing and managing controls from published cybersecurity frameworks such as the NIST CSF, ISO 27001, or other industry-specific frameworks.

Map controls to risks

Make sure that the consultants map the existing security controls to risks and evaluate how effectively those controls mitigate risks. Be skeptical of any controls that do not map to risks, and look for any risks that have no associated controls.

Implement progress reporting

The consultants should provide regular updates to key stakeholders with insights into preliminary findings and any immediate concerns or roadblocks.

Make recommendations

Based on their findings, the consultants should develop actionable recommendations on how to best improve the cybersecurity program.

Provide an executive presentation

Finally, the consultants should provide an executive presentation and walking deck for the executive team, summarizing their findings, recommendations, and an action plan.

This type of external perspective helps to strengthen internal controls, align evidence with audit requirements, and identify high-risk areas before an external audit. And companies that are using automated evidence collection and testing will have an easier time in responding to the consultant’s requests, so that the consultants can focus on a strategic review of the entire cybersecurity program.

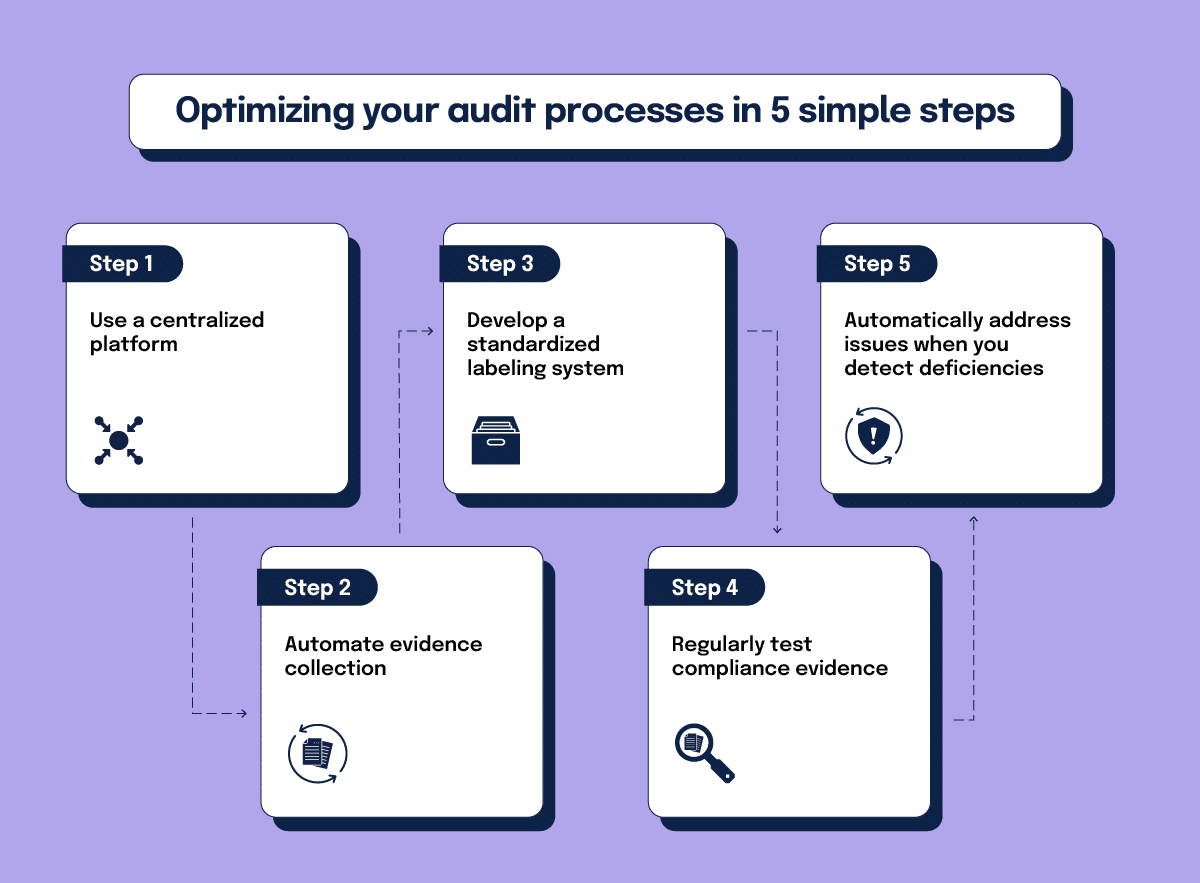

How to optimize your audit processes

Identifying inefficiencies in current audit processes often begins with examining the reliance on manual procedures and disparate systems that can lead to administrative burdens that decrease efficiency. Implementing integrated, automated tools for risk tracking, decision-making, and validating controls can significantly reduce these inefficiencies. Transitioning from manual to automated systems helps organizations to achieve more consistent and reliable audit outcomes, minimizing human error. Here’s how you do it:

Leverage a centralized system

Select a centralized system like Hyperproof for storing all audit-related evidence, which simplifies management, access, and audit preparations.

Automate evidence collection

Use automations like Hypersyncs and workflows to automate evidence collection.

Standardize your evidence labeling system

Develop a standardized labeling system and naming convention for compliance evidence to make it easy to find during audits.

Automatically test evidence

Regularly test compliance evidence on an automatic cadence to ensure the evidence is adequate and sufficient, and identifying any deficiencies or discrepancies early.

Proactively and automatically address issues

Automatically fill issues when you detect a deficiency and track those issues to closure to proactively reduce the risks of audit findings.

These inefficiencies are regrettably common across industries, as shown in multiple reports. For example, The CISO Society 2024 State Of Continuous Controls Monitoring Report highlights that 52% of respondents estimate their teams spend between 30% and 50% of their time on administrative tasks, and 71% of companies take a reactive approach to evidence collection, gathering evidence ad hoc, or only for audits.

Hyperproof’s 2025 IT and Risk Compliance Benchmark Report also notes that many organizations are not effectively monitoring and conducting automated control testing, and are not always confident in their processes for flagging exceptions, reviewing, and remediating issues.

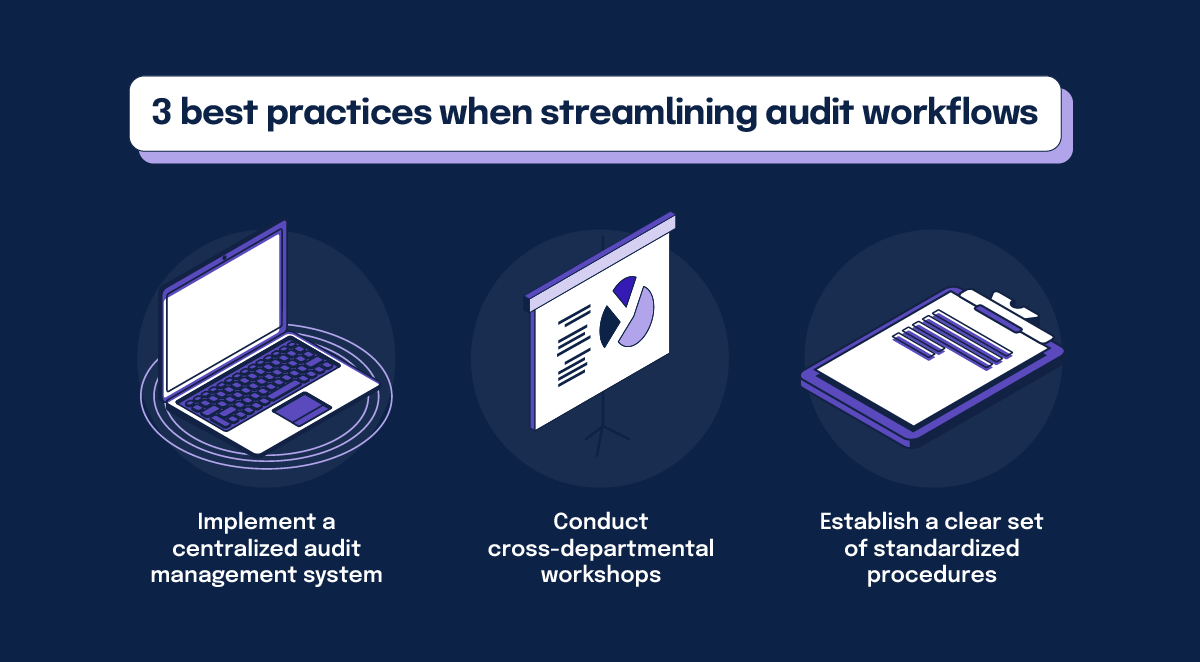

Streamlining existing internal audit workflows involves adopting best practices that ensure efficiency and consistency across departments. For example:

- Implementing a centralized audit management system like Hyperproof streamlines processes and facilitates real-time collaboration.

- Conducting cross-departmental workshops fosters a shared understanding of audit objectives and methodologies.

- Establishing a clear set of standardized procedures ensures uniformity in audit execution across all departments.

Clearly defining roles and responsibilities within audit processes is crucial, as it reduces duplicated or inconsistent work. This can include:

- Creating a detailed responsibility matrix, such as a RACI chart, clarifies who is responsible, accountable, consulted, and informed for each audit task.

- Regularly updating job descriptions to reflect current audit roles ensures clarity and alignment with organizational goals.

- Conducting role-specific training sessions helps team members understand their specific duties and expectations within the audit process.

Providing relevant training to staff ensures everyone is equipped with the necessary skills to perform their roles effectively. Some training techniques are:

- Conducting workshops that simulate audit scenarios helps staff understand the process and their roles in providing evidence.

- Role-playing exercises can prepare those who will speak with auditors, focusing on clear communication and accurate information delivery. This helps give auditors who are conducting interviews adequate time to take notes.

- Interactive Q&A sessions with experienced or former auditors auditors can provide staff with insights into common audit questions and effective response strategies.

By encouraging collaboration between GRC, cybersecurity, and audit teams, organizations can share insights and best practices, leading to more effective communication and streamlined processes. This collaborative approach ensures a comprehensive understanding of the effectiveness of existing controls so teams can make more informed decisions and strategically align with business goals. Integrating audit processes with other governance functions further enhances their relevance and effectiveness, ensuring that audits contribute significantly to achieving organizational objectives.

Using technology for efficient audits

Systems like Hyperproof are revolutionizing the auditing process by providing tools that streamline processes, improve data quality, and enhance collaboration. By granting external auditors access to these systems, organizations can significantly improve the efficiency and accuracy of their audits.

Automation helps make sure that evidence is adequate and sufficient, minimizing the errors that are associated with manual processes and reducing the number of times an auditor must ask for additional evidence. Hyperproof allows mapping evidence across multiple compliance frameworks, which is particularly helpful for global organizations with complex compliance requirements. Auditors can also access up-to-date compliance data instantly, as well as historical records of compliance activities which make evidence sampling faster and easier.

For example, Appian’s use of successful technology integration in auditing shows how modern technologies can align auditing processes with strategic business goals. Appian saved over 100 hours on evidence collection using Hypersyncs, which are data connectors that automatically and continuously pull evidence into the Hyperproof platform. Appian’s experience with Hyperproof highlights the scalability and adaptability of modern solutions, showing how organizations can expand their auditing processes and adjust to evolving regulatory requirements.

By providing real-time insights into compliance status, these technologies enable proactive risk management and timely decision-making. Financially, this integration leads to substantial cost savings by reducing the need for manual labor and decreasing the likelihood of costly compliance errors. Additionally, the ability to adapt to regulatory changes quickly can prevent potential fines and allow their organization to enter new markets rapidly, further contributing to the financial health of the organization.

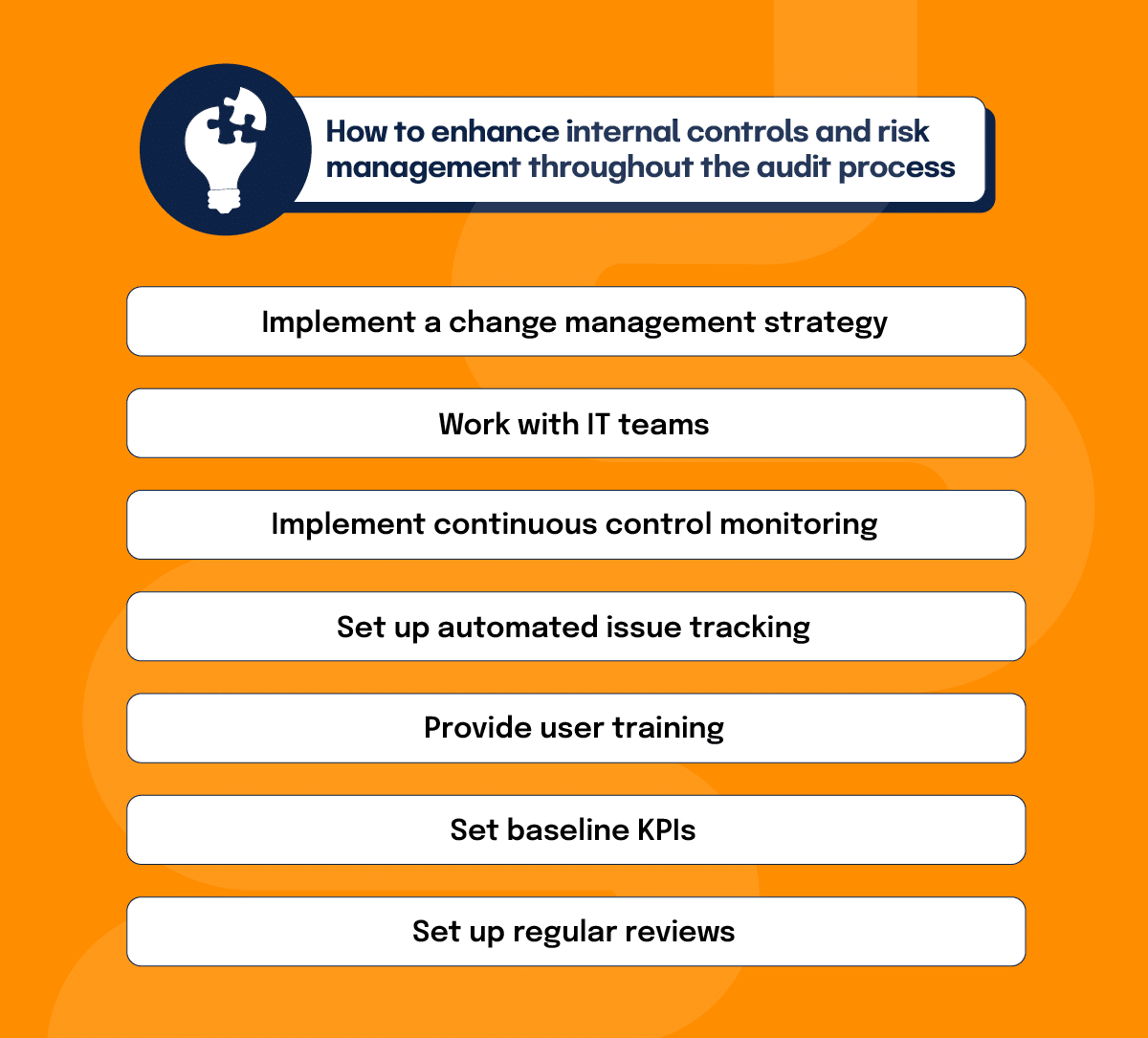

How to enhance internal controls and risk management throughout the audit process

Implementing advanced technology and automation in monitoring the effectiveness of internal controls significantly streamlines audit processes by providing real-time insights and reducing manual errors. This integration allows for more efficient data handling and analysis, ensuring that audits are thorough and accurate. Continuous controls monitoring and evidence collection systems play a crucial role in maintaining the effectiveness of these controls, as they provide ongoing verification of compliance and operational integrity.

To get started, organizations should:

Implement a change management strategy

Implement an organizational change management strategy to reduce resistance by emphasizing the benefits of the system and how it will enhance internal controls and risk management.

Work with IT teams

Work with IT teams to ensure that a tool like Hyperproof has seamless access to collect data about control effectiveness.

Implement continuous control monitoring

Ensure that all controls that can be automatically monitored are, and those that require manual review have automated task reminders for team members to submit evidence regularly.

Set up automated issue tracking

Set up automated issue tracking for control deficiencies to proactively reduce audit findings.

Provide user training

Provide user training for all affected users so they understand how to handle an issue associated with a control, how to manually submit or review evidence, and how to best use real-time monitoring capabilities.

Set baseline KPIs

Establish metrics such as the amount of time it takes to prepare for an audit and how key controls are reducing risks over multiple quarters

Set up regular reviews

Set up regular reviews to evaluate the effectiveness of internal controls, and use these data to make iterative improvements to those controls that have a high volume of issues or are not adequately reducing risks. Where necessary, select or define alternate controls.

Integrating these strategies with the organization’s business goals helps compliance efforts to support long-term objectives and drive value. Continuous monitoring and evidence collection systems provide the data necessary to inform long-term strategies, allowing for timely adjustments and improvements. A strong security culture within the organization can further enhance the effectiveness of internal controls, as team members are more likely to understand and adhere to compliance requirements, ensuring that audits are successful and comprehensive.

How to prepare for multiple internal and external audits

Managing multiple audits simultaneously presents significant challenges, particularly in coordinating efforts across various departments and ensuring that all audit objectives are met without duplication of work. Cross-functional collaboration between GRC professionals, cybersecurity teams, and the internal audit committee is crucial in addressing these challenges.

By sharing insights and best practices, these teams can align their objectives and effectively manage overlapping areas, reducing the risk of inconsistencies and inefficiencies. Integrated audit management tools can further streamline this process by automating scheduling, evidence collection, and reporting, minimizing administrative burdens and enhancing overall efficiency.

Ensuring consistency and accuracy across different audit types is vital for maintaining the integrity of the audit process. Developing and implementing standardized audit frameworks can help achieve this goal by formalizing processes, defining roles, and providing comprehensive training to all involved staff.

These frameworks ensure all audits are conducted with the same level of rigor and attention to detail, regardless of their specific focus. Integrated tools play a key role in maintaining this consistency by providing a unified platform for managing all aspects of the audit process, from planning to execution, ensuring that all audits adhere to the same standards and methodologies.

Tools like Hyperproof allow organizations to define controls once and link those controls to multiple compliance frameworks, which reduces duplication of efforts. This means organizations can reuse the same evidence across multiple audits, which significantly reduces the time and effort required for evidence collection. A familiar interface and workflows helps users with clarity of how to accomplish tasks efficiently. And collaboration features with auditors help reduce the back-and-forth of multiple emails or reminders to control owners, resulting in more consistent audits.

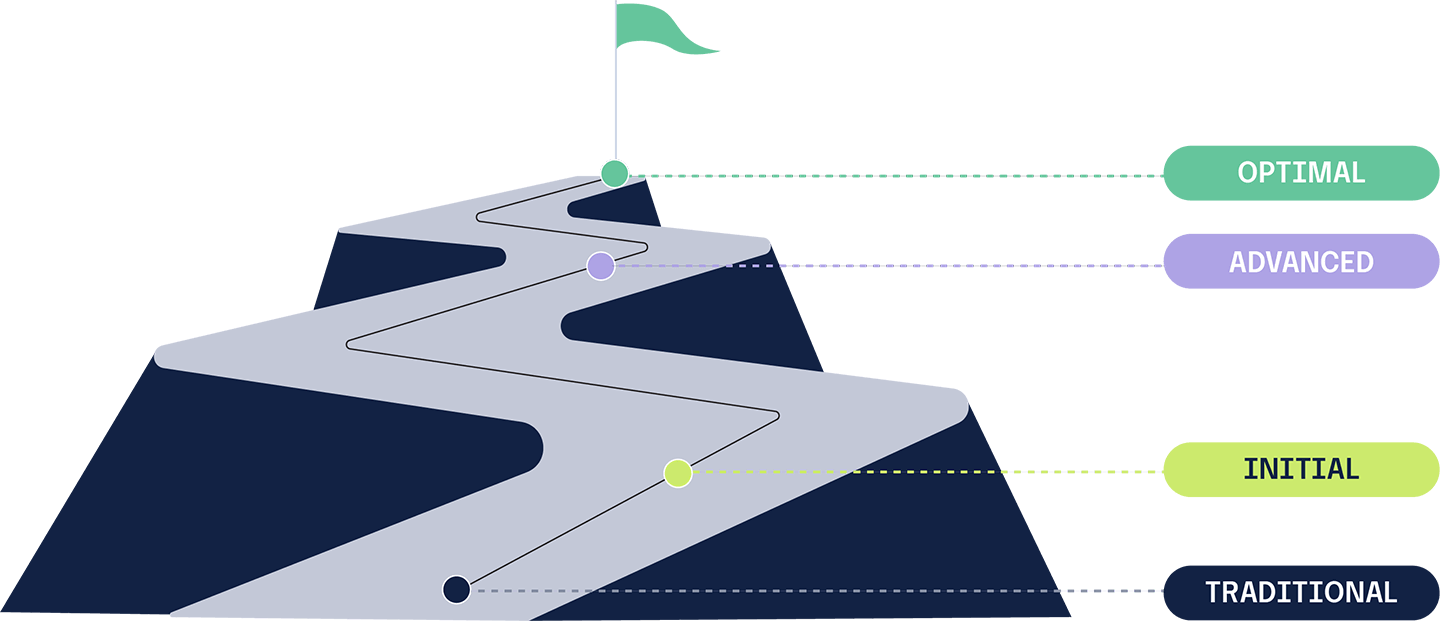

The role of GRC maturity in auditing

Increased GRC maturity can positively impact audit outcomes by focusing on streamlined processes and enhanced efficiency. Hyperproof’s GRC maturity model defines four levels of progressively more mature behaviors by companies designed to move from inconsistent, ad-hoc activities towards a culture of continuous improvement: traditional, initial, advanced, and optimal.

Traditional

Traditional companies struggle with just a single audit, which can make it difficult to achieve the numerous external certifications and attestations expected of modern businesses.

Initial

Initial stage companies that have started to adopt basic tools and workflows, such as spreadsheets and centralized file storage, often spend longer than necessary when preparing for audits due to an emphasis on inconsistent and manual processes.

Advanced

Advanced maturity organizations have consistent processes and extensively use automation for a real-time view into how effectively their organizations are reducing risks while simultaneously preparing for audits.

Optimal

An optimal maturity organization ensures that controls are consistently validated, reducing the time and resources required for audit preparation, with a focus on continuous improvement. This efficiency minimizes disruptions during audits, allowing for a smoother process.

Want to evaluate your GRC maturity?

As organizations mature in their GRC practices, they integrate risk management with strategic decision-making, leading to more comprehensive compliance and risk assessments. This integration provides auditors with a clearer picture of the organization’s risk posture and compliance status. Additionally, optimal GRC practices use quantitative analysis and predictive analytics, offering the internal audit team valuable insights into policy effectiveness and potential future risks. These data-driven insights help auditors to focus on areas of concern.

A culture of continuous improvement of GRC practices is essential for maintaining audit readiness and adapting to new challenges. By incorporating strong feedback loops, organizations can make real-time adjustments to policies and procedures, demonstrating a commitment to proactive risk management.

For example, the GRC Maturity Model defines compliance practices related to managing relationships with regulatory bodies, which includes regularly planned and scheduled interactions with market regulators. If an organization was to learn of an upcoming regulatory requirement, they could proactively develop controls and begin collecting evidence associated with that control well in advance of an audit. This reduces the risk of learning about a new requirement right before an audit and having to force-fit evidence, which often will be found to be both inadequate and insufficient.

This adaptability is essential for audits, as it shows that the organization responds to both emerging threats and regulatory changes. Continuous improvement also ensures that predictive analytics tools evolve with business needs, providing ongoing insights into potential risks. As GRC practices mature, they align more closely with strategic goals, enhancing stakeholder confidence in the organization’s governance.

See Hyperproof in Action

Related Resources

Ready to see

Hyperproof in action?