What is a Compliance Management System?

Keeping up with ever-evolving regulations and customer expectations can feel daunting. The rules and requirements can be particularly stringent and confusing if your organization serves customers in highly regulated industries such as finance, fintech, healthcare, and biotech.

Staying compliant and in good legal standing is essential for protecting your reputation and bottom line. Take cryptocurrency exchange, Binance, as an example of what can happen when a company neglects to follow the law. Binance became the world’s largest cryptocurrency exchange in part because it cut corners by failing to maintain an effective anti-money laundering (AML) program. They were recently fined $4.3 billion for violating the Banking Secrecy Act and its CEO is facing criminal charges.

Focusing on compliance isn’t just about avoiding fines. Compliance can be a business enabler. McKinsey’s latest research indicates that organizations best positioned to build digital trust by implementing solid cybersecurity, data privacy, and responsible AI practices are more likely to see annual growth rates of at least 10% on their top and bottom lines. Further, 85% of research participants said that knowing a company’s data privacy policies is important before making a purchase.

Organizations with a well-defined compliance management system are able to earn the trust of business buyers and consumers. This article will explore how you can build an effective compliance management system that serves your business now and well into the future.

What is compliance management?

Before we explore the nuances of a compliance management system, let’s define the term “compliance management.”

Compliance management is a systematic approach to adhering to laws and regulations. A rigorous compliance management approach includes choosing the right software tools to gain control and efficiency and developing sound business processes, safeguards, and internal controls. This is not a particular piece of technology or specific process, but rather the broader strategy of how your organization adheres to regulations. Modern compliance management software solutions give teams a centralized way to map regulatory obligations to controls, monitor risk, and automate evidence collection so nothing slips through the cracks.

A robust compliance management approach will protect your organization from violating the laws and the downstream negative operational impacts, like:

- Potential fines

- Operational downtime

- Revenue loss

It also helps you catch issues while they are minor and relatively inexpensive to fix so they don’t compound over time.

Your compliance management approach should be tailored to your industry and molded to address your sector’s specific regulatory mandates. It should also be flexible enough to expand as your regulatory environment and business operations evolve.

What is a compliance management system?

A Compliance Management System (CMS) is a collection of tools, business processes, and internal controls that work together to help organizations maintain compliance. This structured framework defines how your organization manages regulatory compliance in a scalable and efficient manner.

The CMS encompasses everything from how an organization develops its company policies and employee training initiatives and the technology it selects to monitor its business processes, flag issues, and streamline compliance activities. It contains the documents, processes, and internal controls that help the organization fulfill its legal obligations, promote ethical business practices, and build trust with business customers and consumers.

The CMS should define how the organization:

- Learns about its compliance responsibilities

- Ensures employees understand these responsibilities

- Ensures that requirements are incorporated into business processes

- Reviews operations to ensure responsibilities are carried out and requirements are met

- Gathers evidence or proof of compliance and control effectiveness on an appropriate cadence

- Provides channels for employees to report issues to the compliance team

- Maintains a process of continuous improvement so compliance teams and operators can take corrective actions when necessary

A compliance management system provides your organization with a centralized approach to policy development and reviews, managing compliance requirements, auditing and reporting. Today, tech-savvy compliance teams are leveraging advanced techniques, such as continuous risk and control monitoring tools, to inject a high degree of automation into their CMS. This enables them to proactively identify emerging risks and take corrective actions in near real-time, instilling confidence in the system’s capabilities.

3 critical components of a compliance management system

At its core, a CMS has three major elements:

1. The Board of Directors

The Board supervises the CMS, ensuring that the CMS meets your company’s current compliance obligations and keeps up with emerging risks. The Board should set clear risk appetite and compliance expectations, adopt policy positions that guide policy development, appoint a compliance officer, allocate sufficient resources to the compliance function, and ensure that periodic audits are conducted to assess the effectiveness of the current CMS. The Board’s role is crucial in shaping a culture of compliance from the top down.

2. The Compliance Officer

The Compliance Officer is a key member of the senior leadership team. While the Board develops the framework and the strategy, the Compliance Officer brings it to life. They work closely with the rest of the senior leadership team to develop company policies, assess risks, and customize the CMS to fit with the business’s operational realities. Their team is responsible for leading employee training and education, and policy reviews, handling complaints, liaising with auditors and providing reports to regulatory authorities. They also ensure that any identified compliance issues are promptly addressed with corrective actions taken to prevent future violations.

The key responsibilities of a compliance officer are:

- Policy development: Developing and implementing the institution’s compliance policies and procedures.

- Training and education: Ensuring management and staff receive ongoing training on relevant consumer protection laws, regulations, and internal compliance policies.

- Policy review and monitoring: Regularly review policies and procedures to ensure compliance with applicable laws, regulations, and the institution’s internal policies

- Risk assessment: Continuously assess emerging regulatory issues or potential areas of non-compliance, identifying and mitigating risks as they arise.

- Handling consumer complaints: Ensure that consumer complaints are adequately addressed and resolved to meet regulatory requirements.

- Reporting and communication: Provide regular reports on compliance activities and issues to senior management and the Board.

- Taking corrective actions: Ensuring any uncovered compliance issues are promptly addressed with corrective actions. Updating policies and procedures to prevent future violations

The most effective compliance teams use software tools to stay on top of emerging regulatory issues. They stay close to the operational realities of their business, build solid working relationships with managers and employees across all parts of the organization, and use technology to streamline compliance management processes.

Compliance audits

Audits are independent reviews of your organization’s compliance management system, serving as a checkpoint to ensure that your organization adheres to both external regulations and internal policies. They are your safety net — they catch gaps and minor issues before they turn into bigger problems. Audits also help management identify ways to strengthen their compliance management system.

Typically speaking, a written compliance audit report will include:

- Scope of the audit (including departments, branches, product types and third-party relationships reviewed)

- Deficiencies or modifications identified

- Number of transactions sampled by category of product type

- Descriptions of (or suggestions for) corrective actions and timeframes for correction

Once an audit is complete, audit findings should be reported to the Board or the audit committee of a board.

What makes a CMS effective?

Based on our experience working with hundreds of organizations, the effectiveness of a CMS system ranges from highly effective to “needs significant improvement.”

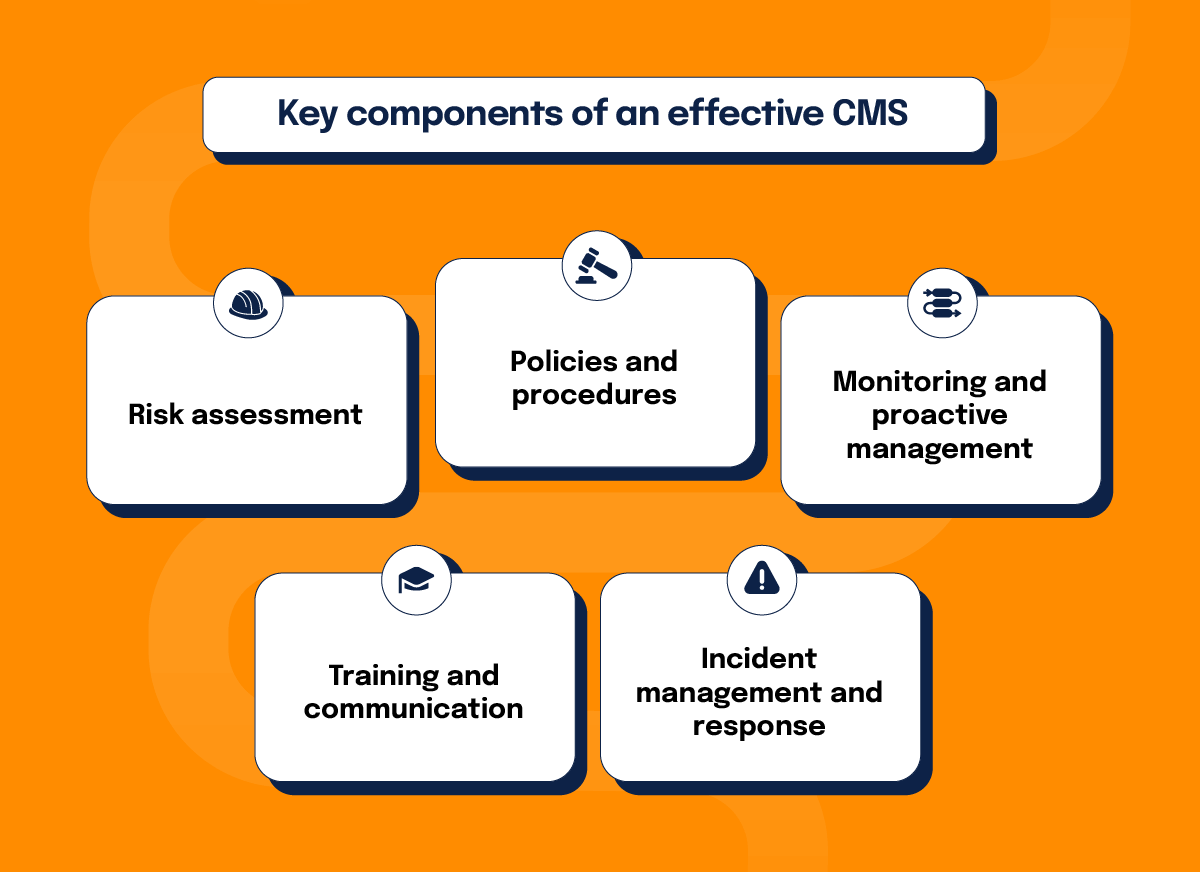

An effective CMS has the following elements:

Risk assessment

Your organization needs to regularly assess its specific risks, considering everything from dynamics in your markets to how your operations are evolving to regulatory changes affecting your industry. A comprehensive risk management strategy will help you stay ahead.

Policies and procedures

At the heart of every CMS are documented processes and procedures aligning with industry regulations and internal policies. These “playbooks” ensure your team knows what’s expected and how to make decisions in various situations. Like any good playbook, they should be reviewed and updated as your business, technology stack and regulations evolve.

Monitoring and proactive management

When you regularly monitor operations and identify any weaknesses in processes, system configurations or employee training, you can stay aligned with regulations, build digital trust, and avoid nasty surprises.

Training and communication

Compliance programs can’t function well without attentive and knowledgeable employees. An effective compliance system depends on your team being up-to-date on laws, policies and staying alert. Regular training ensures employees understand the “why” behind compliance efforts, making them active participants in maintaining standards.

Incident management and response

When issues arise (and they will), a CMS should have a plan to respond quickly. Take time to develop incident response plans, run simulations, and train employees so everyone can immediately spring into action when an incident happens.

Key elements of an effective incident program for a company should include:

- A well-defined incident response plan

- Clear roles, and responsibilities for staff

- A structured approach to communicating information and robust communication channels

- A process for analyzing incidents to identify patterns and improve responses,

- Continuous improvement practices

- A system (including documentation) to learn from past incidents

Learn more about how to create a cybersecurity incident response plan ->

The business benefits of a compliance management system

When you invest effort in building a CMS, your organization will reap various benefits:

Risk mitigation

A CMS helps you avoid the pain of fines, penalties, and damaged reputations. It allows you to catch potential issues before they escalate and become more expensive to fix, acting as an early warning system for your business. Your business operations will be smoother.

Enhanced trust

Trust is now a competitive advantage. A CMS shows clients, partners, and regulators that you’re committed to ethical practices, which can help you attract and retain business.

Informed decision-making

With a CMS, you get a holistic view of your compliance activities and risk areas, giving you the insights needed to make informed decisions, allocate resources effectively, and stay ahead of any potential compliance hurdles.

Efficiency gains and scalability

When you integrate compliance considerations into daily operations and use compliance automation software, your organization can avoid the inefficiencies that come with handling compliance audits using reactive, ad-hoc processes and manual tools.

One of the biggest benefits of building a CMS is its scalability. When compliance teams use a CMS that comes with control crosswalks — mappings of common requirements between different compliance frameworks — they can more easily comply with the requirements of multiple regulators with a unified set of controls and streamline their documentation.

Hyperproof recently surveyed over 1,000 IT compliance and risk management professionals. Hyperproof’s 2024 IT Risk and Compliance Benchmark Report found that only 18% of respondents have successfully tied together their risk and compliance activities. After experiencing inefficiencies in compliance management for so long, many organizations are now finding relief by unifying their risk and compliance management efforts and choosing software that helps them centralize their risk management and compliance activities.

Implementing a compliance management system

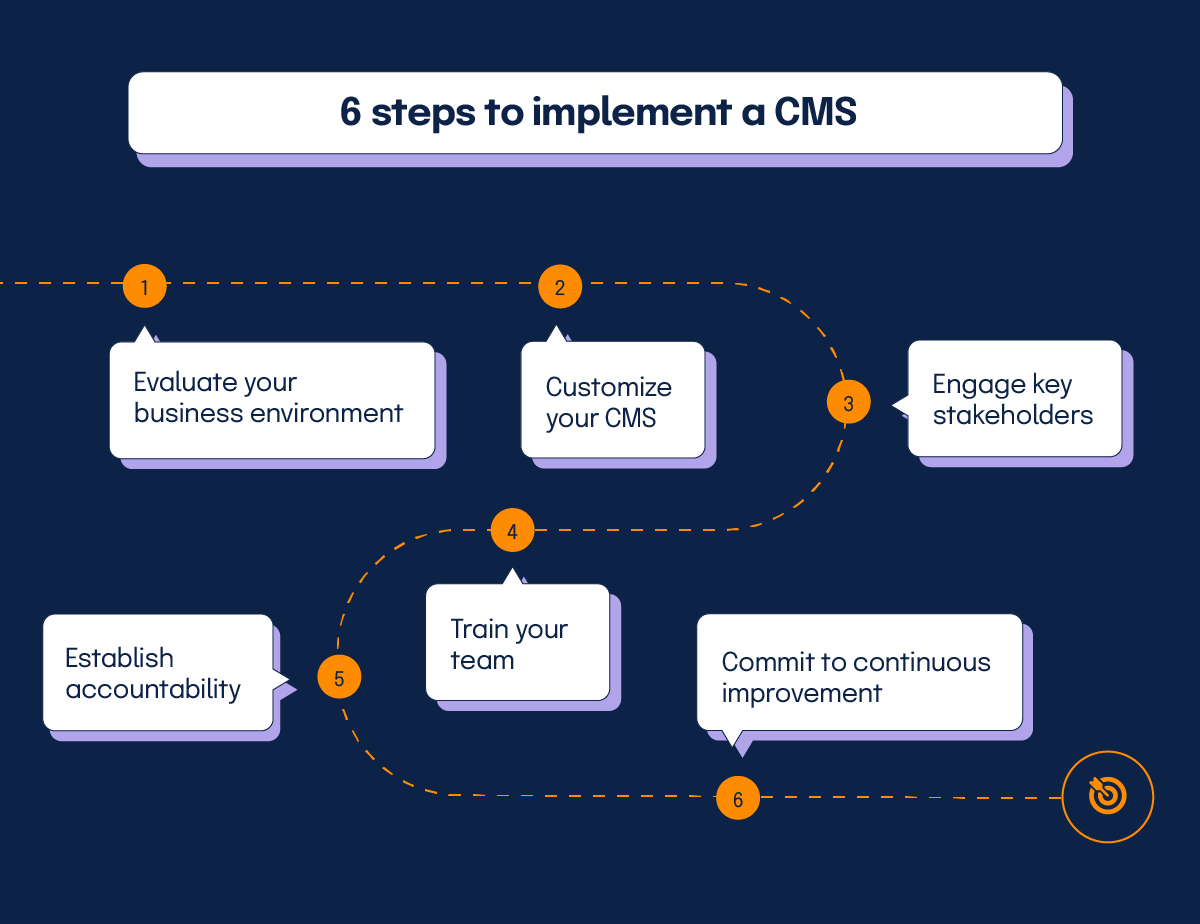

Ready to get started? Here’s a step-by-step approach:

1. Evaluate your business environment

Understand your specific compliance needs and objectives based on your business environments. There are many compliance frameworks that are well-suited for various company types. For instance, if you want your business buyers to trust you with their sensitive customer data, you’ll likely need to get a SOC 2 Type 2 report before buyer organizations are willing to use your software. If you’re processing the financial data of consumers, you’ll need to understand and follow rules and standards like the Gramm-Bliley Act (GLBA) – Privacy Rule & Safeguard Rule, and Payment Card Industry Data Security Standard (PCI DSS).

Practically speaking, you should find compliance frameworks that make sense for your company stage, the requirements and expectations of your customers, the operational complexity of your business, and the regulations and rules governing your industry.

2. Customize your CMS

Once your compliance needs are clear, it’s time to customize your CMS to align with your organization’s structure and processes. This usually involves developing controls or compliance safeguards that fit your business workflows, technology usage preferences and processes. You’ll assign roles and responsibilities to individuals and integrate your CMS with other tools in your organization like Jira, Asana, and ServiceNow so it works efficiently and harmoniously with your existing business environment.

3. Engage key stakeholders

Building a culture of compliance starts at the top. Bring your Board and senior management into the process early on — they’ll play a key role in prioritizing compliance throughout the organization.

Practically speaking, you’ll need to educate leadership on the value of a robust compliance program to the company’s top line and future sustainability. Focus on clearly communicating the potential risks and business impacts of non-compliance, articulating how your program aligns with business goals, presenting a time-bound plan with a budget, and actively involving senior leaders in key decision-making processes such as what CMS to implement.

4. Train your team

Compliance is a company-wide effort. Through regular training, you can ensure everyone understands their respective role and the importance of compliance.

To help employees become stewards of your compliance program, make training engaging, relevant to specific roles, and accessible through multiple mediums. Further, regularly reinforce the training, encourage open reporting of concerns, and keep training materials up-to-date to reflect changing regulations and business processes.

5. Establish accountability

Set clear expectations for compliance across all levels of the organization. Take time to define clear roles and actions for employees such as system administrators, department leads and others who play first-line-of-defense roles in building and maintaining digital trust in your organization.

In practice, communicating such detailed instructions promptly to frontline employees in various roles is incredibly time-consuming. Software platforms like Hyperproof can alleviate this burden. With Hyperproof, you can publish instructions on operating controls and assign those controls to various owners so you can ensure the work gets done. Control owners receive reminders to review and assess controls automatically at any cadence, and compliance teams can centrally review tasks and know which team members have outstanding work to do.

6. Commit to continuous improvement

A CMS should evolve with your business. Dedicate resources to ongoing monitoring, assessment and improvement to keep your system responsive to your organization’s evolving operations and regulatory landscape. Software like Hyperproof makes comprehensive monitoring possible through provision of real-time reports and a streamlined system to track all corrective actions and the evolution of controls within your organization.

How Hyperproof can help you build an effective and efficient CMS

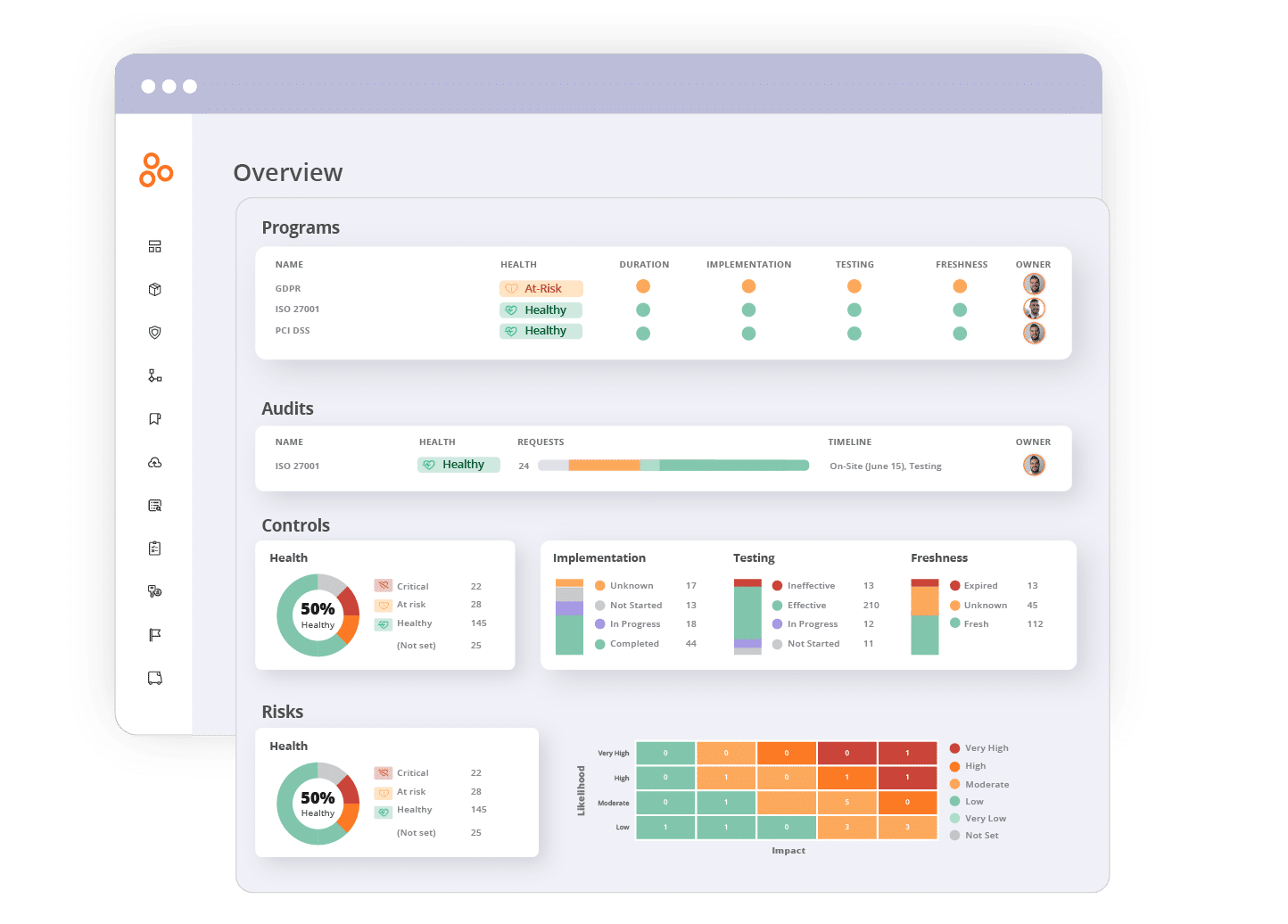

Organizations are building and maintaining highly effective compliance management systems with Hyperproof’s platform. Hyperproof centralizes compliance work, providing all stakeholders with visibility into all risk and compliance workstreams. It also automates processes around audit preparation, conducting assessments, and control testing and remediation.

With a modern compliance and security platform like Hyperproof, you can connect risk, audit, and compliance workflows in one place so stakeholders share a single, reliable view of your CMS.

Hyperproof makes it easy for compliance teams to:

- Maintain comprehensive visibility of enterprise risks and its compliance program

- Ensure that the right owners are assigned to maintain controls and program oversight

- Keep employees abreast of their specific responsibilities and compliance tasks

- Monitor controls, gather evidence of effectiveness and test controls automatically

- Conduct periodic and one-time assessments to build plans to evolve the CMS

- Track risks and prioritize remediation efforts to strengthen digital trust

Want to learn more?

Check out our customer story on Outreach to see a tangible example of how an organization implemented a compliance management system using Hyperproof.

See Hyperproof in Action

Related Resources

Ready to see

Hyperproof in action?