How to Conduct an Internal Audit: A Comprehensive Guide

External compliance audits and third-party attestations (e.g., SOC 2) have become increasingly crucial in B2B purchase decisions. Not only do they provide an objective third-party verification of a vendor’s security/compliance posture, but audits also provide helpful information about the soft spots or weaknesses in an organization’s internal control environment. In other words, findings from a formal audit can serve as a recipe for reducing risks.

Although formal external audits have their place, they shouldn’t be relied upon as the only means of learning about your organization’s security gaps. In today’s fast-evolving risk environment, organizations need a combination of methods to protect themselves adequately. In addition to scheduled formal audits, organizations should continuously conduct internal audits to identify vulnerabilities and understand their compliance and security posture.

Not addressing risks continuously is a dangerous practice because organizations are exposed to risks and threats on an ongoing basis.

With fast-evolving risk environments, organizations need a combination of methods to protect themselves adequately. In addition to scheduled formal audits, organizations should conduct internal audits to identify vulnerabilities and understand their compliance and security posture continuously.

In fact, a survey conducted by Globalscape and the Ponemon Institute found that companies that engaged in frequent compliance audits reduced their compliance costs by an average of $2.86 million. On the other hand, the survey found that companies that do not conduct compliance audits at all experience the highest compliance costs.

Conducting internal audits allows your company to understand the gaps/soft spots in your internal control environment — so you can close those gaps before external auditors show up at your office and have certainty that you’ll pass that external audit.

In this article, we’ll discuss the critical differences between internal vs. external audits, what internal auditors do, the different types of internal audits your organization may conduct, as well as the key steps to conducting a successful internal audit.

The crucial role of compliance and internal audits

Company employees conduct internal audits to gauge overall risks to compliance and security and determine whether the company is following internal guidelines. Internal compliance audits should occur throughout the year. Management teams can use the reports generated from internal audits to identify improvement areas. Internal audits measure company objectives against output and strategic risks.

Comparing internal and external audits: understanding the differences

Internal and external audits have different purposes, but ultimately, they both serve the same end: making sure your company complies with regulations as well as internal/external standards so you can avoid business disruptions and fines, penalties, or reputational damage that may be the result of compliance violations.

External audits are formal audits carried out by an independent third party. An external audit measures the organization’s processes and controls at a point in time against some external standards, such as ISO 27001 or NIST 800-53. But they can also be mandatory if a business has a data breach or another security event non-compliant with a legally required standard.

On the other hand, internal audits are conducted by trained employees within your organization. The scope of an internal audit may be reasonably narrow or relatively wide.

The internal auditor’s role and responsibilities

Internal auditors have a unique role: they must be completely objective about the processes and teams they are evaluating, and they can’t be directly connected to the departments they’re auditing. Internal auditors typically report directly to senior management or board members. Their job is to assess departments or business functions objectively and how they meet set standards. It’s important to remember that an auditor’s job is ultimately to help the business, and their feedback informs how to build a more substantial business.

The Institute of Internal Auditors (IIA) is the largest and most widely recognized association serving and setting standards for internal auditors. They provide certifications in different areas of internal auditing, and they developed the Standards & Guidance – International Professional Practices Framework, which provides internal auditors with mandatory and recommended guidance on their role and the mission of internal auditors.

The type of activities an auditor performs will vary somewhat depending on what kind of audit they’re performing. Still, there are some activities crucial to any type of internal audit.

Assessing controls within the internal audit process

Whether an auditor is assessing the accounting department’s process for end-of-year financials or the marketing department’s compliance with CCPA, they will review and evaluate the controls in place that are intended to mitigate risks and prevent undesirable incidents. Almost any business process needs to have some type of control and accountability in place to ensure there aren’t opportunities to cut corners or create issues. Auditors look at the documented controls and the controls being implemented to ensure they’re executed and working as intended.

Identifying and evaluating risks during an internal audit

While management at every level needs to use their unique knowledge to identify the risks to their team and the larger organization, it is an auditor’s job to evaluate those risks, anticipate future issues with those risks, and find ways to either control or remove them.

The process of analyzing operations

Internal auditors must understand an organization’s strategic objectives and how things work at the tactical level. They work with lower-level managers, analyze operations, and determine whether those operations fit the company’s strategic objectives.

Collaborating with other assurance providers

Internal auditors work alongside risk management professionals, compliance officers, and others to assure executives in their company that risks are managed effectively and efficiently. While many other assurance provider roles implement processes and develop controls to mitigate risk, internal auditors evaluate those controls and processes to ensure they’re working and meet the standards they need, whether set internally or externally.

5 types of internal audits

There are a few different types of internal audits, and each provides value. If you’re just starting to develop your internal audit function, you don’t need to jump into executing all of these at once. However, it’s a good idea to set your sights on eventually performing these types of internal audits because they each allow you to optimize a different part of your business operations.

IT compliance audit

An internal IT compliance audit reviews a business’s data security practices to determine whether they’re compliant with required or chosen data security frameworks and standards and legal requirements a company might face regarding data security and privacy. An internal audit can be used as a test run to see how that business would fare in a formal external audit. Because the consequences of falling out of compliance can be costly for a company, compliance audits should be done frequently. Lower-risk, less complex processes can be audited once or twice yearly, while more complicated and higher-risk processes should be audited regularly (e.g., weekly).

IT audit

An IT audit is focused on information technology controls and processes. While this overlaps with a compliance audit, some IT functions aren’t included in compliance audits. In addition to ensuring that the IT controls in place are safeguarding information, an internal IT audit also reviews whether IT processes and assets (hardware and software) are operating efficiently. Unlike a compliance audit, IT processes aren’t compared to an external standard in an IT audit. Instead, the audit looks at whether they are serving their purpose and helping the company meet its goals.

Financial audit

A financial audit looks at a business’s finances to ensure that financial activities are recorded correctly and that the correct accounting practices are used. It’s imperative that these types of audits are conducted by someone impartial and disconnected from the accounting and finance functions of the business; if they find something illegal or fraudulent, they need to be able to go to management with their concerns immediately.

Operational audit

An operational audit is focused on the performance of a department or business function. The auditor will look at the processes and outputs of the department and evaluate how they contribute to the company’s key objectives. The auditor will consider the staff, management of assets in the department, outputs, productivity, and organizational structure.

Investigative audit

An investigative audit happens in response to a report or complaint about suspicious behavior by an employee or team within the company. In this case, the audit would include an employee or department’s output. Then, if the report is credible, they would assess the extent of the losses, determine what weaknesses allowed it to happen, and create recommendations for what needs to be done to prevent it from happening again in the future.

The step-by-step internal audit process

Because every business is different and different types of audits require various steps and considerations, there isn’t a single audit process that will work for every audit in every company. However, you can follow a basic audit formula to ensure you collect all of the necessary information and utilize what you learn effectively. These are the four phases in every successful internal audit:

How to plan your internal audit

Before beginning an audit, the internal audit team should define the scope and objective of the audit. Approaching an audit without a clearly defined goal leads to scope creep, which is when the project’s scope keeps growing to include additional issues or processes that the team encounters. Deciding what is and isn’t inside the scope of your audit before beginning will allow your team to work efficiently and make decisions on what to include easily.

During this phase, you’ll also determine who the stakeholders are, what process owners will be involved in the audit, set a timeline, and look at previous audits (if any exist) to see if there are any issues you should be prepared to encounter. You should come away from this planning phase with a documented audit plan that will guide you in executing the audit.

Generally speaking, to create a solid audit plan, you should consider a few elements:

Existing regulations

Understanding the regulatory requirements of the area(s) you’ll be auditing is critical to conducting an effective audit.

Employee concerns

If employees have previously expressed concerns about specific processes, you should incorporate questions into your audit plan to dig into the issues.

Evidence needed to test controls

You should think through what types of evidence you’ll need to gather to test the controls within the scope of the audit.

Fieldwork strategies: evidence collection and testing in the internal audit process

Fieldwork, also known as evidence collection and testing, usually involves interviews with process owners to understand the process and controls, reviewing process documentation, testing the controls currently in place for the process, and documenting your findings and recommendations.

During this step, you should review all the available data about the process under audit. Data generated before your audit should give you an unfiltered look at the process and whether there are discrepancies between what the interviewee is telling you and reality. It will also potentially provide you with backup for your recommendations when you present changes you think should be made to upper management.

Reporting findings: the culmination of the compliance audit process

Once you have completed your fieldwork, you will compile your findings and recommendations into an audit report. An audit report will summarize the audit plan, describe your results — specifically, what you found was not in conformance with internal standards or external requirements — and discuss your recommendations.

Remember that the goal of an internal audit is to identify issues and come away with a plan for improving processes or functions. The audit report is not about assigning blame or pointing fingers; it’s about identifying where processes are not working, the consequences, and how those issues can be rectified. Identified issues should be taken seriously and not minimized or explained away. The audit report should ultimately showcase company strengths and how those can resolve problems identified in the audit.

The follow-up: ensuring continuous compliance after an internal audit

The final stage of an audit is following up on the recommendations to ensure implementation and how problems have been resolved. This follow-up should be recorded alongside the rest of the audit information to be considered during future audits.

What internal audits should not do

Internal auditors should not design or implement the controls — the policies, procedures, processes, and technical components put in place within their organization. Their job is to objectively assess the controls the operations teams (e.g., engineering, sales, HR, finance, etc.) have put in place to determine whether the control designs are suitable for the intended objective of the controls, whether controls were implemented effectively, and whether controls operated consistently.

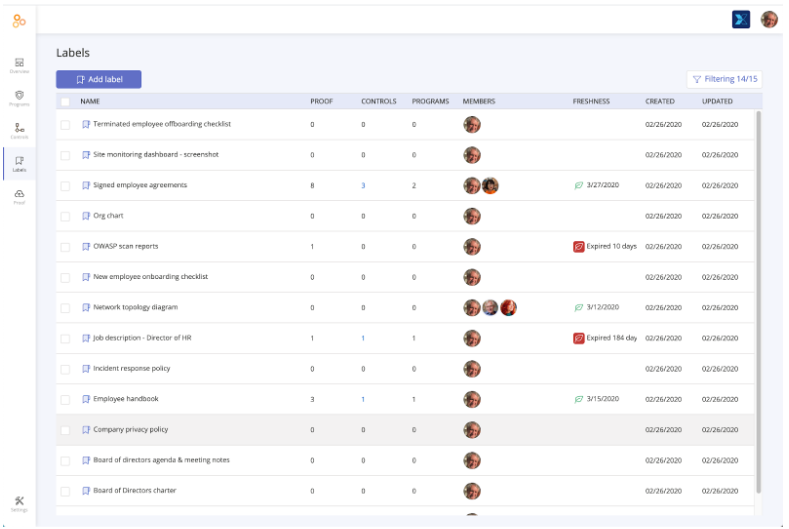

Enhancing efficiency in internal and external audits with Hyperproof

Hyperproof reduces the amount of administrative overhead in typical auditing processes. The application is specifically built to help internal auditors and compliance professionals collect and manage the compliance evidence they need to review to understand and verify how well the current compliance audit procedure works and what’s not working.

Hyperproof can serve as a central repository for all of an organization’s compliance requirements, risk assessments, controls (along with their description, owner), and evidence. In Hyperproof’s audit management software, it’s easy for an internal auditor to request control operators and business process owners across an organization to submit evidence they need to test. Control owners can come directly in Hyperproof to provide proof for the controls they’re responsible for, and that information is linked to a specific request in your audit plan.

Instead of sending emails and manual calendar invites to colleagues to remind them to review evidence or submit new evidence, internal auditors can use Hyperproof to issue tasks with due dates and reminders. Then, control operators are automatically notified when it’s time to review and submit fresh evidence.

Additionally, internal auditors can configure Hyperproof to automatically extract proof of the effectiveness of specific controls from many business apps and developer tools (e.g., Pull requests and approvals from GitHub). This way, internal auditors can focus on testing the evidence instead of spending lots of time just trying to gather the data.

Colleagues in the business units will also be glad they won’t need to respond to audit requests as often. Once an internal audit or compliance team feels they’re prepared for an external audit, they can “share their work” with the external auditor directly in Hyperproof and expose only the information they want to share. To learn more about Hyperproof or see a demo of all its capabilities, visit Hyperproof today.

See Hyperproof in Action

Related Resources

Ready to see

Hyperproof in action?