What is a risk control matrix?

Audit and compliance professionals need many tools to do their jobs well, and perhaps none is as important — and useful — as a risk control matrix, sometimes called a compliance risk assessment matrix. While an RCM provides the granular details needed for an audit, it often serves as the primary data source for a broader corporate risk matrix. This high-level view allows leadership to see how specific control risks roll up into the organization’s overall strategic objectives.

A risk control matrix illuminates the relationship between the risks and controls at your organization, or even just within a specific project your team is undertaking. Designed smartly, risk control matrices help you bring structure to your internal audit or risk management program. They deliver efficiency (or, more accurately, they eliminate the wasted time of manual processes), pave the way for better reporting, and give you greater confidence on the overall state of risk management at your business.

Sounds great, right? At a practical level, however, audit and compliance teams still face many challenges in building the right sort of risk control matrix for your organization and putting it to full use. This post explores those challenges and how to overcome them.

Before we get into the mechanics of a risk control matrix, it helps to briefly define control risk. In audit and compliance language, control risk is the risk that your existing internal controls will fail to prevent or detect a material error, misstatement, or non-compliant activity in time. In other words, even if you’ve designed controls, there’s always some chance they won’t work as intended – and the whole point of a risk control matrix is to make that control risk visible and manageable.

What is a risk control matrix?

A risk control matrix (RCM) is just what the name suggests: a matrix that maps out the risks your organization has and the controls used to address those risks. It’s also one of the most practical tools you have to define control risk at a granular level – for each risk, you can see exactly which controls are supposed to keep it in check and how strong or weak that control environment really is. Imagine it as a two-dimensional grid, with risks along the vertical axis and controls along the horizontal. A compliance officer could locate a specific risk on the vertical axis, and then read entries on the horizontal axis to see who “owns” that risk, what controls are in place to contain it, when that control was last tested, and so forth.

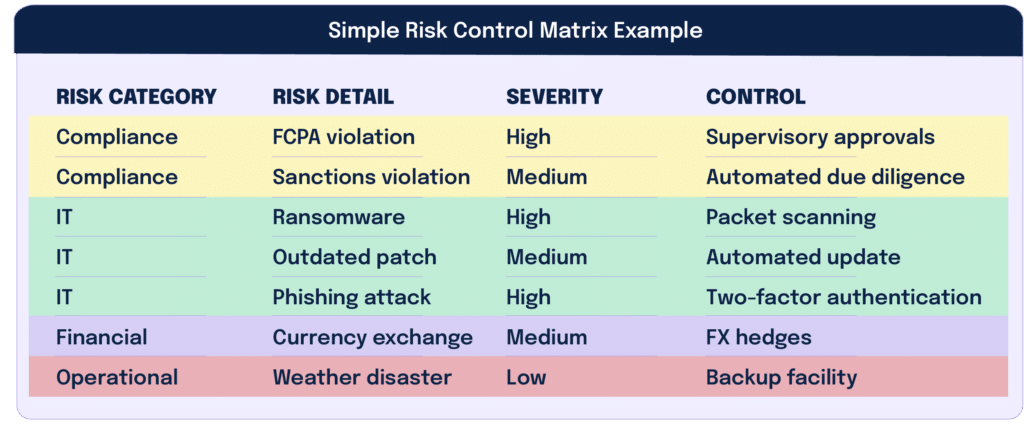

We can get more complicated from there. For example, most RCMs will group risks across several basic categories, such as:

- Compliance

- Cybersecurity

- Operational

- Financial

- Fraud

In the next column you might organize the risks further, like according to severity: high, medium, or low. Subsequent columns running along the horizontal axis could then provide a description of the control, the control owner, date of last control test, compensating controls should the primary control fail, and other categories.

A simple RCM could look something like the below.

In practice, most RCMs will be more extensive (and complicated) than our example above. A comprehensive RCM could have dozens of risks on the vertical axis and 10 or more fields on the horizontal axis discussing various controls in place to address each risk.

3 important tips for a quality risk control matrix

Already, however, we can see a few important points about RCMs emerge.

1. Do not record the data manually

First, while RCMs use the structure of a spreadsheet, recording the information manually in a spreadsheet is a recipe for disaster. People will forget to record data, record it in the wrong field, or simply get lost in a sea of columns and rows that make holistic analysis and reporting of your risk posture impossible. Automation is crucial if you want to reap all the benefits that RCMs can provide. If you’re trying to mature beyond spreadsheets, control testing in risk management becomes the practical next step — moving from “documented controls” to repeatable testing cycles and tracked remediation.

2. Set the correct scope for your risk control matrix

Second, setting the correct scope for an RCM is a crucial first step. Otherwise your RCM might wind up cluttered with unnecessary information or risks unrelated to your specific organization.

3. Collaborate to get a consensus on your organizational risks

And third, collaboration and consensus are also crucial for the success of RCMs. That is, all parts of your enterprise should have a single, agreed-upon understanding of what your risks are, as well as the severity of those risks. You should also all draw from one single source of data about risks. Otherwise, different parts of the enterprise might end up with “dueling” RCMs that reach different conclusions about risk and control, which does nobody any good.

Why should I use a risk control matrix?

The best way to answer this question might be to consider the scenario where you don’t use RCMs to manage risk. How would that work? Poorly, at best.

In the absence of an RCM, your risk management program is far more likely to be a hodgepodge collection of emails, process narratives stored in Word files, spreadsheets, and collective memory that may or may not be correct. Without a structured view, it’s almost impossible to clearly define control risk for specific processes or assertions; you’re guessing how exposed you are instead of measuring it. RCMs bring discipline and structure to your risk management program — and the alternative of an unstructured, undisciplined program no longer meets the expectations of senior management, the board, regulators, business partners, or other stakeholders.

Beyond that conceptual argument, we can also list plenty of more specific reasons to use an RCM, too.

6 reasons to use a risk control matrix

1. Better risk assessments

An RCM forces you to identify, assess, and prioritize risks in a systematic way. By doing so, you gain a holistic view of potential threats, which drives better decision-making.

2. Better risk mitigation

An RCM also helps you to design and implement specific control measures to mitigate the risks you find. That helps you to catch risks early, before they escalate into major crises.

3. Regulatory compliance

Many industries (financial services, for example) have extensive regulatory compliance obligations. An RCM helps your business adhere to those rules by documenting control procedures and monitoring their effectiveness.

4. Efficiency gains

As you work through your RCM, you might find duplicative controls that can be consolidated or outdated controls that can be eliminated. You can streamline processes, reduce inefficiency, and enhance the overall effectiveness of your controls.

5. Transparency

A matrix provides a structured way to communicate risk and control information across the whole enterprise. Everyone can see and understand the risks that face their specific team and their role in risk management.

6. Audit readiness

Along similar lines to our previous point, if your organization is subject to an audit, an RCM provides transparency to auditors as well. They can understand your perception of risks, identify which controls they might want to test, and what audit work you’ve already done. An RCM also demonstrates your commitment to good risk management and compliance.

Ultimately, a risk control matrix allows for better, more data-driven decisions. The compliance team can have better conversations with senior management or the board as you make those decisions, and that’s a strategic advantage anyone should embrace.

How can a risk control matrix integrate into other GRC efforts?

A risk control matrix is so useful because it can easily integrate into and support other parts of your governance, risk, and compliance (GRC) program. Indeed, to reap the most benefit from your RCM, integrating it into your larger program is essential. Examples include:

Control mapping

Mapping your existing controls to various cybersecurity frameworks (SOC 2, PCI DSS, HIPAA, NIST 800-53 and more) is often crucial to demonstrate compliance. An RCM can illuminate which controls map back to what framework requirements — or which controls are absent, and that you’ll need to implement.

Policy management

Policies are essential for defining how an organization should operate and manage risks; in many instances, a policy itself can be a control. Your RCM can link controls to specific policies to assure that risk mitigation measures align with your established policies and procedures.

Incident response

In the event of a security breach or incident, your RCM can help you to identify which controls failed or were bypassed. This information is invaluable for incident response teams to understand the root cause and take corrective action.

Reporting and analytics

A well-structured RCM generates data that can be used for GRC reporting and analytics. It allows organizations to track control effectiveness, identify trends, and make data-driven decisions to improve risk management strategies.

We could keep going with potential uses around vendor risk management, operational controls, and more. The fundamental point is that a risk control matrix brings clarity to your risks and risk management efforts. That clarity can then feed into other elements of your GRC program and improve their efficiency.

The ultimate goal is to integrate all these GRC program elements into one unified system of continuous improvement, where risk assessments and control enhancement happen seamlessly and continuously, to give your business a strategic advantage in today’s digitally transformed, highly inter-dependent marketplace.

How do I build a risk control matrix?

For those who want to build a risk control matrix, the good news is that launching your first RCM is relatively straightforward.

Building a risk control matrix in 4 easy steps:

1. Assemble your team

Begin by assembling the correct team across your enterprise. An RCM lists the risks that your company faces. You’ll need to bring together leaders from finance, legal, HR, IT security, and probably other functions as well to brainstorm about the risks and controls your company does (or does not) have.

2. Identify and categorize your risks

Next, identify and categorize the risks your company faces. As we saw in the example risk control matrix above, you can group risks by category and then describe them in more precise detail.

3. Determine your controls

Third, determine controls for each risk. These controls should be actionable and specific, and document each one.

4. Document your work in the risk control matrix

Finally, document your work in the RCM itself. Whether you use a spreadsheet for a rudimentary RCM or a dedicated tool for something more sophisticated, the RCM should list each risk, its associated controls, responsible parties, and key risk indicators.

Of course, that’s only the abstract theory of building a risk control matrix. In practice, doing all this with manual processes will (as we mentioned earlier) quickly start to unravel. So compliance leaders should always think about how to integrate your RCM efforts into a larger GRC program. Only then can you embrace automation to the fullest, and gain precise insights into your company’s compliance posture and overall risk management.

Control Risk & Risk Control Matrices FAQs

What is control risk?

In simple terms, control risk is the chance that your internal controls won’t prevent or detect an error, fraud, or non-compliance in time. When auditors or compliance teams define control risk, they’re talking about the residual exposure that remains even after you’ve designed and implemented your controls.

How does a risk control matrix help with control risk?

A risk control matrix makes control risk visible. For each risk, you can see which controls exist, who owns them, how often they’re tested, and how effective they are. That structure helps you quantify where control risk is high, where it’s acceptable, and where you need to strengthen your control environment.

Once you achieve that state, however, your organization will be well-positioned to work with its business partners, keep customers and regulators happy, and thrive.

Take an inside look at how AppLovin, an end-to-end software and AI solution, built a strategic risk program with Hyperproof, supporting company growth, increasing transparency with senior leadership, and saving time on routine tasks.

See Hyperproof in Action

Related Resources

Ready to see

Hyperproof in action?