What is CCPA Compliance? A Beginner’s Guide

Navigating the world of data privacy can feel like learning a new language, especially when acronyms like “CCPA” start popping up in every conversation. If your organization collects, processes, or sells personal data from California residents, understanding the California Consumer Privacy Act (CCPA) isn’t just beneficial — it’s essential.

If you’re seeking to learn more about the CCPA, this guide will help you grasp the basics of CCPA compliance, why it matters, and how you can take actionable steps to meet its requirements.

What is the CCPA?

The CCPA, enacted in 2018 and effective since January 1, 2020, is a landmark data privacy law that gives California residents greater control over their personal information. It’s often referred to as California’s version of the EU’s General Data Protection Regulation (GDPR), though the two laws differ in scope and implementation.

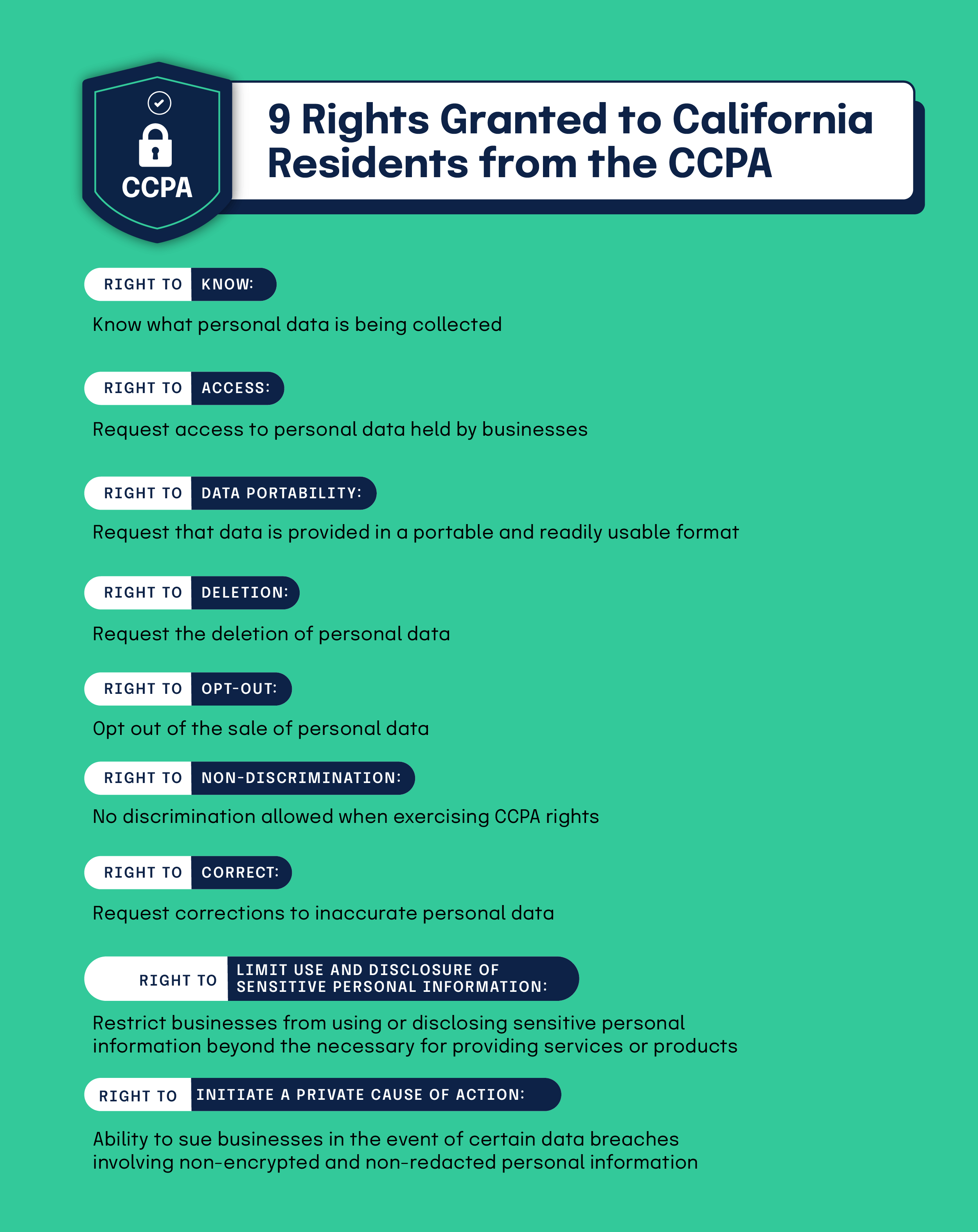

The CCPA grants California residents the following nine rights:

1. The right to know

Consumers have the right to know what personal data is being collected about them.

2. The right to access

Consumers can request access to their personal data held by businesses.

3. The right to data portability

Consumers can request that their data be provided in a portable and readily usable format.

4. The right to deletion

Consumers can request the deletion of their personal data.

5. The right to opt-out

Consumers can opt out of the sale of their personal data.

6. The right to non-discrimination

Consumers have the right not to be discriminated against for exercising their CCPA rights.

7. The right to correct

Consumers can request corrections to inaccurate personal data.

8. The right to limit use and disclosure of sensitive personal information

Consumers can restrict businesses from using or disclosing their sensitive personal information beyond what is necessary for providing services or products.

9. The right to initiate a private cause of action

Consumers can sue businesses in the event of certain data breaches involving non-encrypted and non-redacted personal information.

Does the CCPA apply to you?

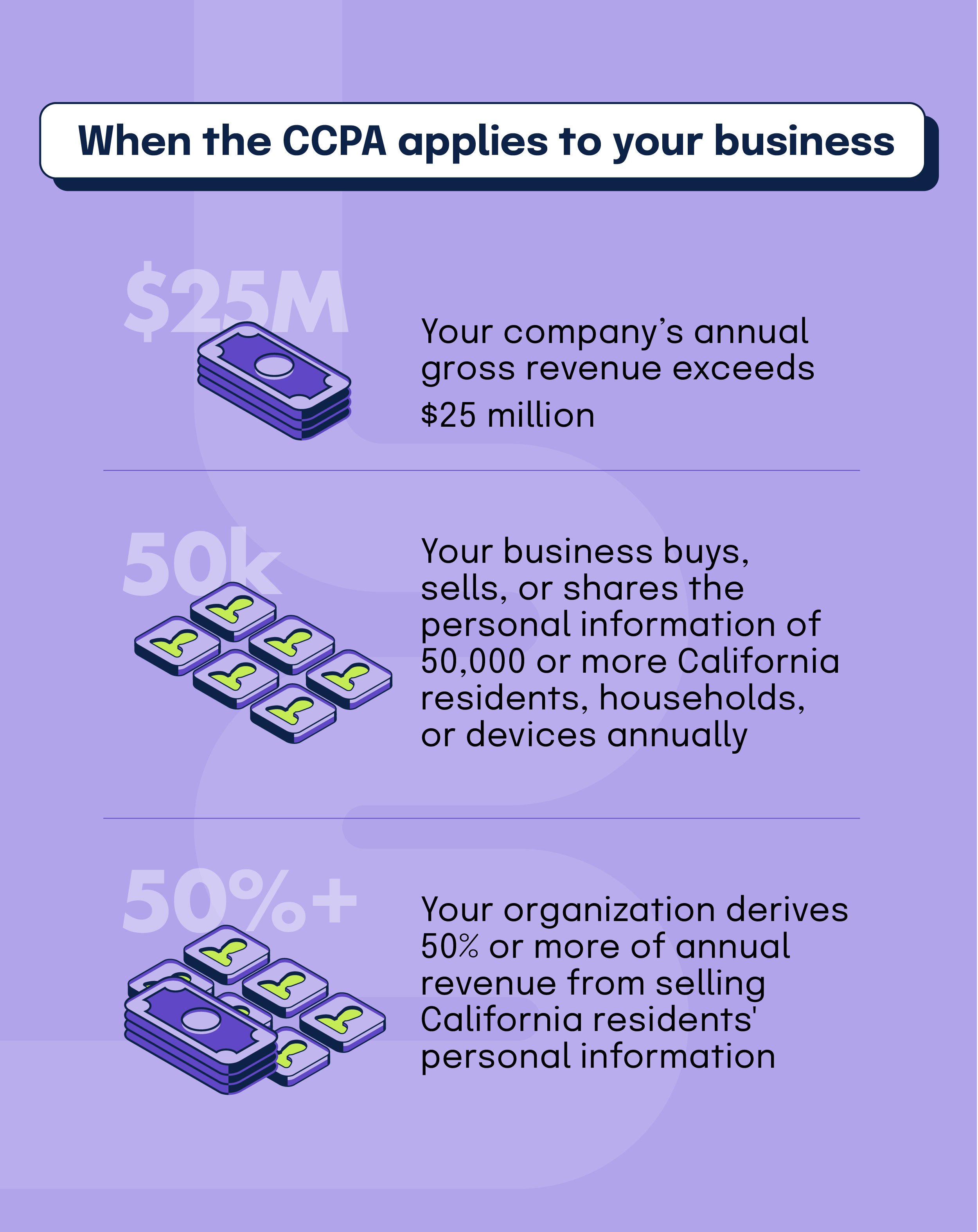

Before diving into compliance requirements, you need to determine if the CCPA actually applies to your business or not. The law covers for-profit entities that meet at least one of the following criteria:

- Your company’s annual gross revenue exceeds $25 million.

- Your business buys, sells, or shares the personal information of 50,000 or more California residents, households, or devices annually.

- Your organization derives 50% or more of annual revenue from selling California residents’ personal information.

Even if your organization is based outside of California, the CCPA could still apply if you interact with California residents and meet one of the thresholds.

Key definitions to understand

To comply with the CCPA, you’ll need to familiarize yourself with its terminology:

Personal information

Any information that identifies, relates to, or could reasonably be linked to a particular individual. Examples include names, IP addresses, geolocation data, and purchase histories.

Sale of information

Broadly defined as the sharing of personal data for monetary or other valuable consideration.

Service provider

A company that processes information on behalf of a business and is bound by specific contractual obligations under the CCPA.

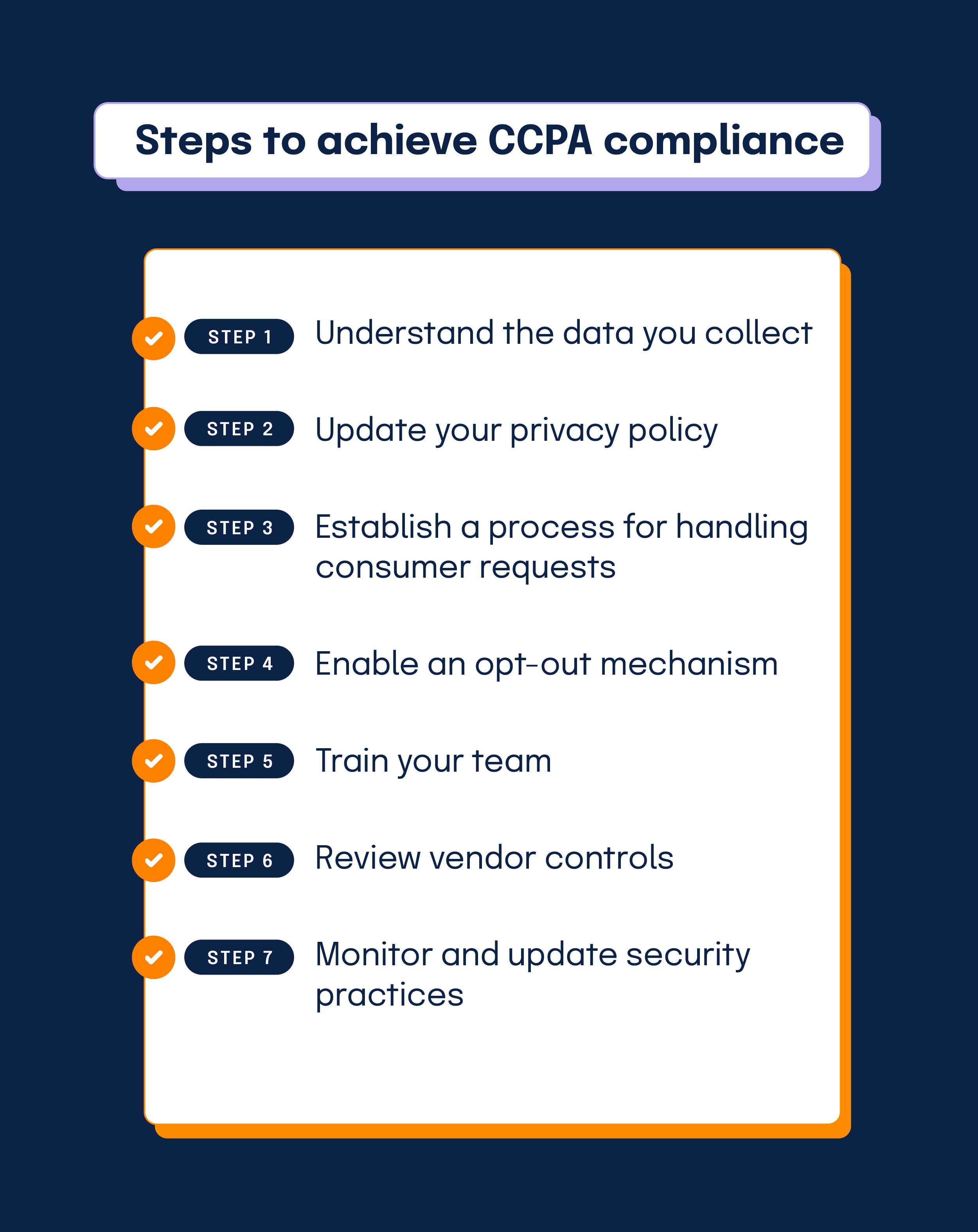

Steps to achieve CCPA compliance

CCPA compliance might seem daunting at first glance, but breaking it down into manageable steps can make the process more approachable. Here are the steps you need to follow to achieve CCPA compliance.

Step 1: Understand the data you collect

Start with a data inventory. Identify:

- What personal information you collect.

- How it’s used.

- Where it’s stored.

- Who has access to it.

This helps you map your data flows and understand your exposure to CCPA requirements.

Pro tip:

Leverage automated tools or software to conduct your data inventory. Manual tracking often leads to gaps, especially in larger organizations. Automation can help uncover hidden data silos, streamline processes, and maintain ongoing visibility into your data ecosystem. Additionally, segment your data by type and sensitivity to prioritize compliance efforts more effectively.

Step 2: Update your privacy policy

Your privacy policy must clearly explain:

- The categories of personal data collected.

- The purposes for collection.

- The rights consumers have under the CCPA.

- Instructions for exercising those rights.

Transparency is critical, so ensure your policy is easily accessible and written in plain language.

Pro tip:

Test your privacy policy with a sample group of stakeholders or consumers. Use their feedback to ensure it’s both clear and comprehensive. A policy that’s overly technical or vague can create confusion and erode trust. Also, make it visually appealing and easy to navigate, especially on mobile devices where users often access information.

Step 3: Establish a process for handling consumer requests

You’re required to provide at least two ways for consumers to submit requests to know, delete, or opt-out of the sale of their personal information, such as:

- A toll-free phone number.

- An online form or email address.

Businesses are required to respond to consumer requests within 45 days of receipt. This period can be extended by an additional 45 days when reasonably necessary, provided the consumer is notified of the extension within the initial 45-day period. And businesses must maintain records of consumer requests and how they responded to them for at least 24 months to ensure accountability and compliance with the CCPA.

Pro tip:

Set up workflows to handle high volumes of requests efficiently. Assign specific roles to team members, use templates for common responses, and track requests in a centralized system. This reduces the risk of errors or delays. Additionally, proactively educate your consumers about their rights and how they can make requests to minimize confusion.

Step 4: Enable an opt-out mechanism

If your organization sells personal information, you must provide a clear and conspicuous “Do Not Sell My Personal Information” link on your website. This opt-out mechanism ensures compliance with consumer opt-out rights.

Pro tip:

Conduct usability testing on your opt-out mechanism. Ensure the link is visible and the process is straightforward. Avoid burying the link in lengthy pages or footers. A simple, user-friendly interface will not only ensure compliance but also reduce frustration among consumers, boosting your brand reputation. Ensure your opt-out mechanism is aligned with privacy regulations, including CCPA, GDPR (right to object to data processing), and Nevada’s opt-out law (SB-220). Consider implementing geo-targeting to display opt-out options only to users in covered locations, while offering a general preference center for all visitors.

Step 5: Train your team

Your employees, particularly those handling customer data or compliance tasks, should understand their roles in CCPA compliance. Regular training can help them recognize data-related requests and respond appropriately.

Pro tip:

Make training sessions interactive and tailored to specific roles. For instance, your IT team might need technical training on data protection, while your customer support team may need to focus on handling consumer requests. Offer accessible training options, such as self-paced e-learning modules, recorded webinars, and live workshops. A varied approach accommodates different learning styles and schedules. Regular feedback sessions can help employees voice challenges and suggest improvements. Beyond compliance, a strong privacy-aware culture strengthens consumer trust and reduces the risk of legal penalties by ensuring data protection remains a top priority across your organization.

Step 6: Review vendor contracts

Vendors and third-party service providers play a crucial role in your compliance strategy. Update contracts to include clauses prohibiting the sale or misuse of personal data shared with them.

Pro tip:

Conduct a vendor risk assessment to identify high-risk relationships. Beyond updating contracts, ask vendors to provide evidence of their own compliance efforts, such as certifications, policies, or audits. Building a compliance checklist for your vendors ensures you’re covering all potential vulnerabilities in your data supply chain.

Step 7: Monitor and update security practices

The CCPA requires businesses to implement “reasonable” security measures. While the law doesn’t specify what these are, a proactive approach includes encryption, access controls, and incident response planning.

Pro tip:

Conduct a mix of internal and external security audits, in addition to penetration tests, to evaluate the overall effectiveness of your security program. External audits can provide an unbiased assessment, while internal reviews ensure continuous improvement. Define key security metrics to measure the effectiveness of your controls, such as incident response times, detection rates, and compliance with security policies. Regularly track improvements and adjust strategies as needed. Additionally, schedule tabletop exercises to test and refine your incident response plans, ensuring your team is prepared to handle real-world threats efficiently.

The benefits of CCPA compliance

Compliance isn’t just about avoiding fines; it’s also an opportunity to build trust with your customers. When consumers know you prioritize their privacy, it strengthens their loyalty and confidence in your brand. If your privacy posture seems shady or obscure, it can scare customers away. Plus, establishing robust data practices now positions you well for future regulations, such as the California Privacy Rights Act (CPRA), which expands on the CCPA.

Common CCPA compliance pitfalls (and how to avoid them)

Even well-intentioned organizations can stumble on the path to compliance. Here’s how to sidestep some common challenges:

Failing to track all data

Without a comprehensive data inventory, you risk overlooking crucial information, leading to compliance gaps.

Incomplete privacy policies

Regularly review and update your privacy policy to reflect changes in your data practices.

Ignoring vendor responsibilities

Your vendors must adhere to CCPA requirements too. Neglecting this can expose you to risks.

Inadequate documentation

Maintain detailed records of your compliance efforts to demonstrate your commitment in case of an audit.

Lack of consumer request handling process

Without a clear process, you risk missing deadlines and violating compliance rules. Establish a streamlined workflow, train staff, and use automated tracking tools to ensure timely responses.

Ignoring data security requirements

Weak security measures increase breach and legal risks. Implement encryption, access controls, and regular security audits to maintain compliance and protect consumer data.

Overlooking third-party data sharing

Even non-sale data sharing can trigger CCPA obligations. Review vendor contracts, ensure proper data protection clauses, and conduct regular audits to prevent compliance gaps.

Non-compliance with opt-out requests

Failure to honor opt-outs can result in violations and loss of consumer trust. Implement a robust opt-out mechanism, verify compliance across systems, and conduct regular checks to ensure enforcement.

Misunderstanding the definition of “sale”

The CCPA’s broad definition includes some data-sharing practices that may seem exempt. Assess all data exchanges, consult legal guidance, and update policies to align with regulatory interpretations.

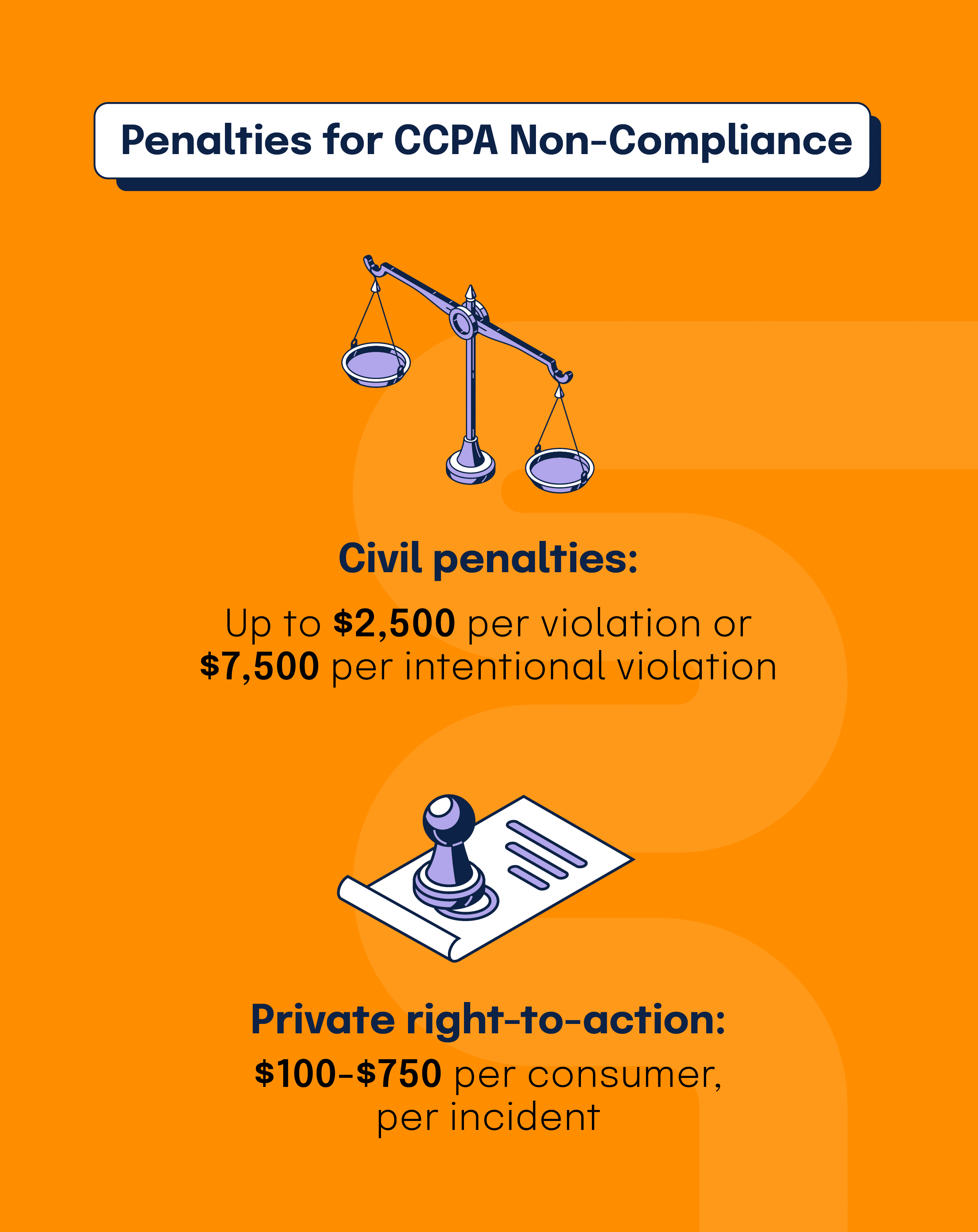

Penalties for CCPA non-compliance

Non-compliance can result in significant fines:

Civil penalties

Up to $2,500 per violation or $7,500 per intentional violation.

Private right of action

Consumers can sue if their non-encrypted personal information is exposed due to a data breach, with statutory damages ranging from $100 to $750 per consumer per incident.

Taking the CCPA seriously not only mitigates these risks but also reinforces your reputation as a trustworthy organization.

How can Hyperproof streamline CCPA compliance?

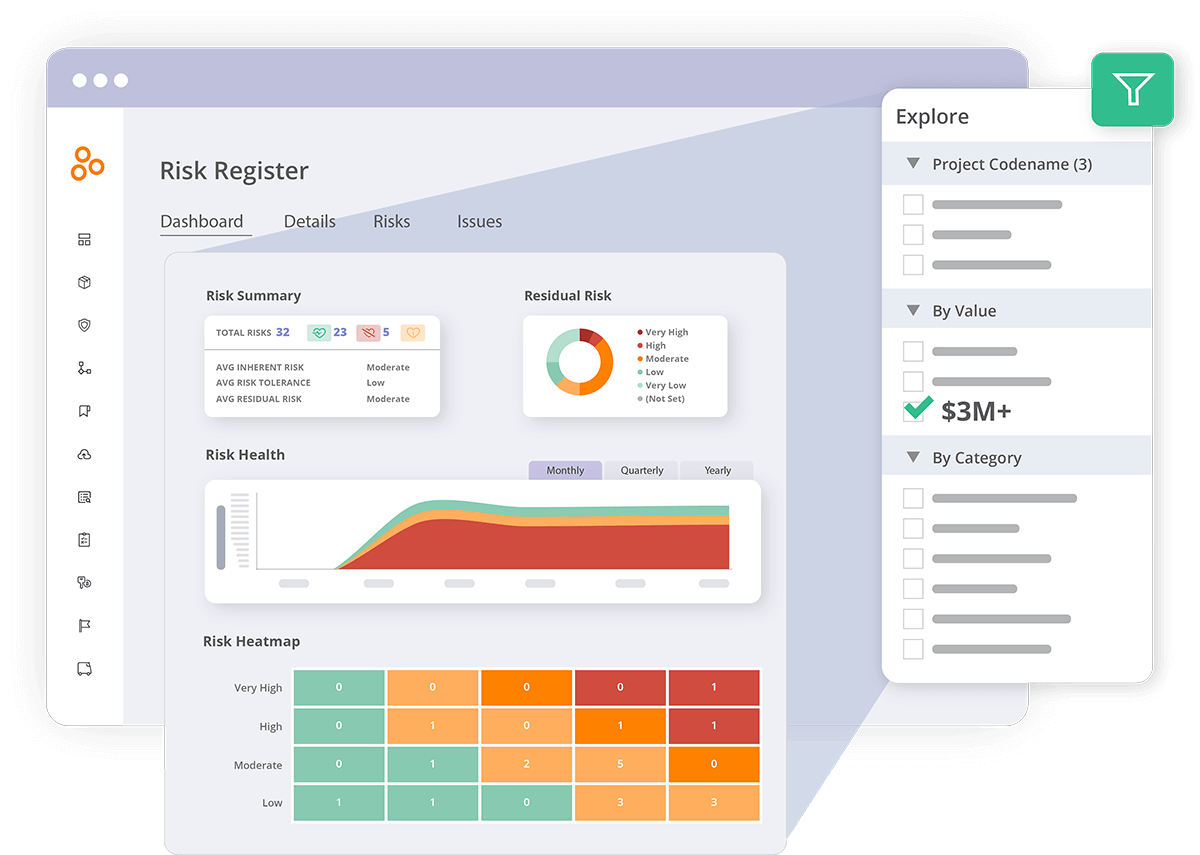

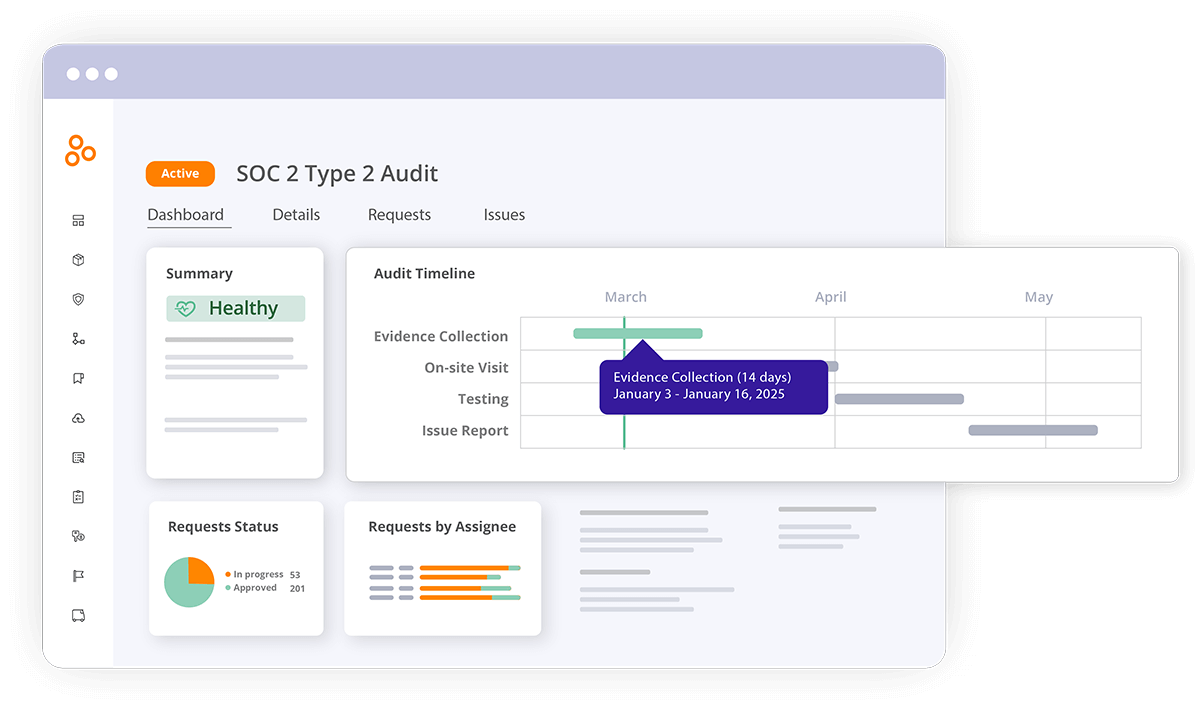

When it comes to compliance, efficiency and organization are everything. Trying to manage your obligations manually — especially in a fast-paced business environment — can quickly become overwhelming. This is where technology steps in to simplify the process. Hyperproof is designed specifically for compliance management. We offer a centralized way to manage your CCPA compliance program effectively and consistently. Here’s how we help you do it right:

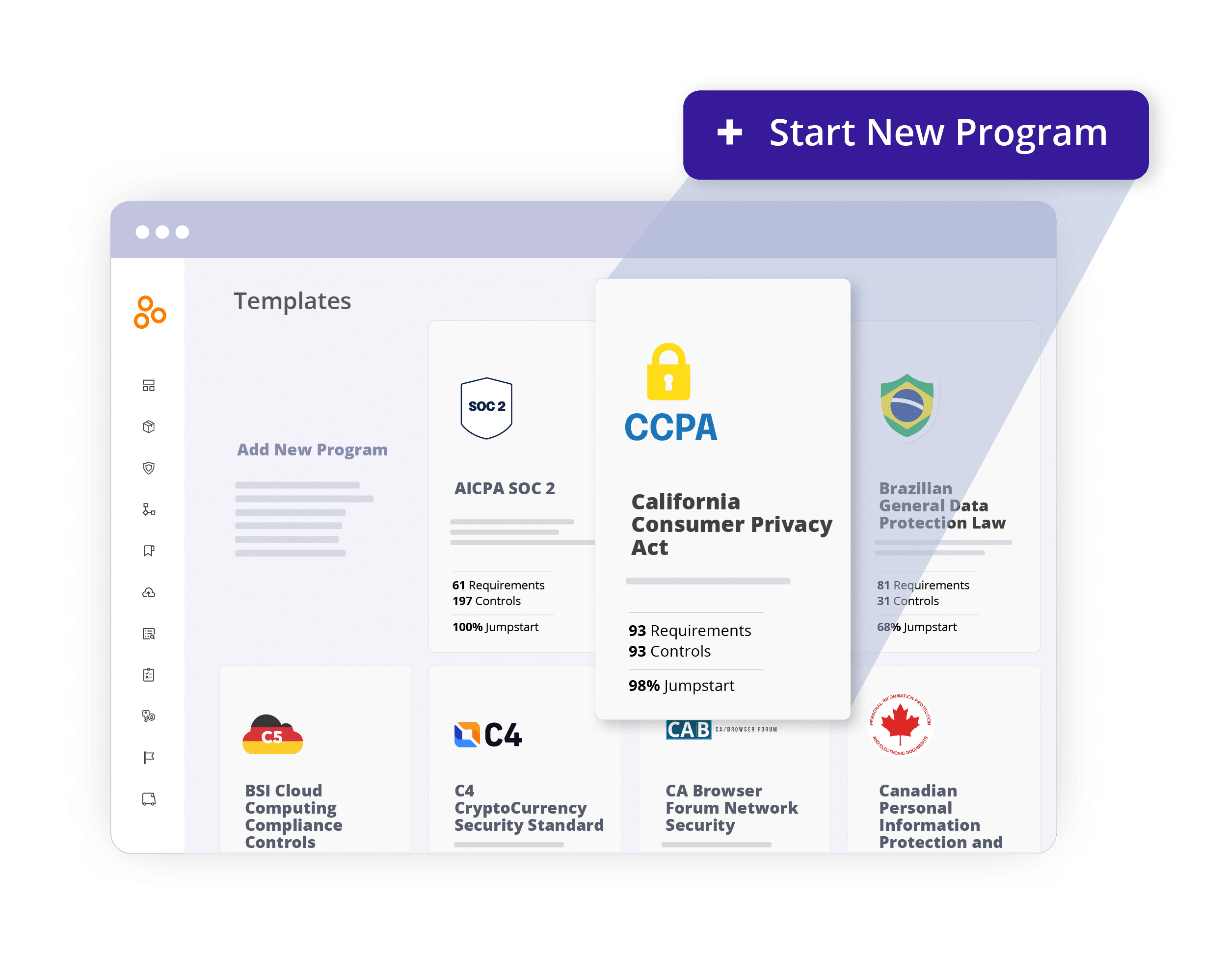

1. Streamline control mapping

CCPA compliance requires robust policies and controls to manage how personal information is handled. Hyperproof comes with an out-of-the-box CCPA framework template, which includes recommended security actions and controls that provide a starting point to meet your organization’s unique needs. Once you get CCPA stood up, Hyperproof helps you track, assess, and monitor the effectiveness of your controls, ensuring that policies related to data collection, processing, and protection are followed. By centralizing control management, you gain visibility into compliance gaps, can assign accountability, and ensure that remediation efforts stay on track. This proactive approach supports regulatory alignment and prepares your organization for audits and consumer data requests.

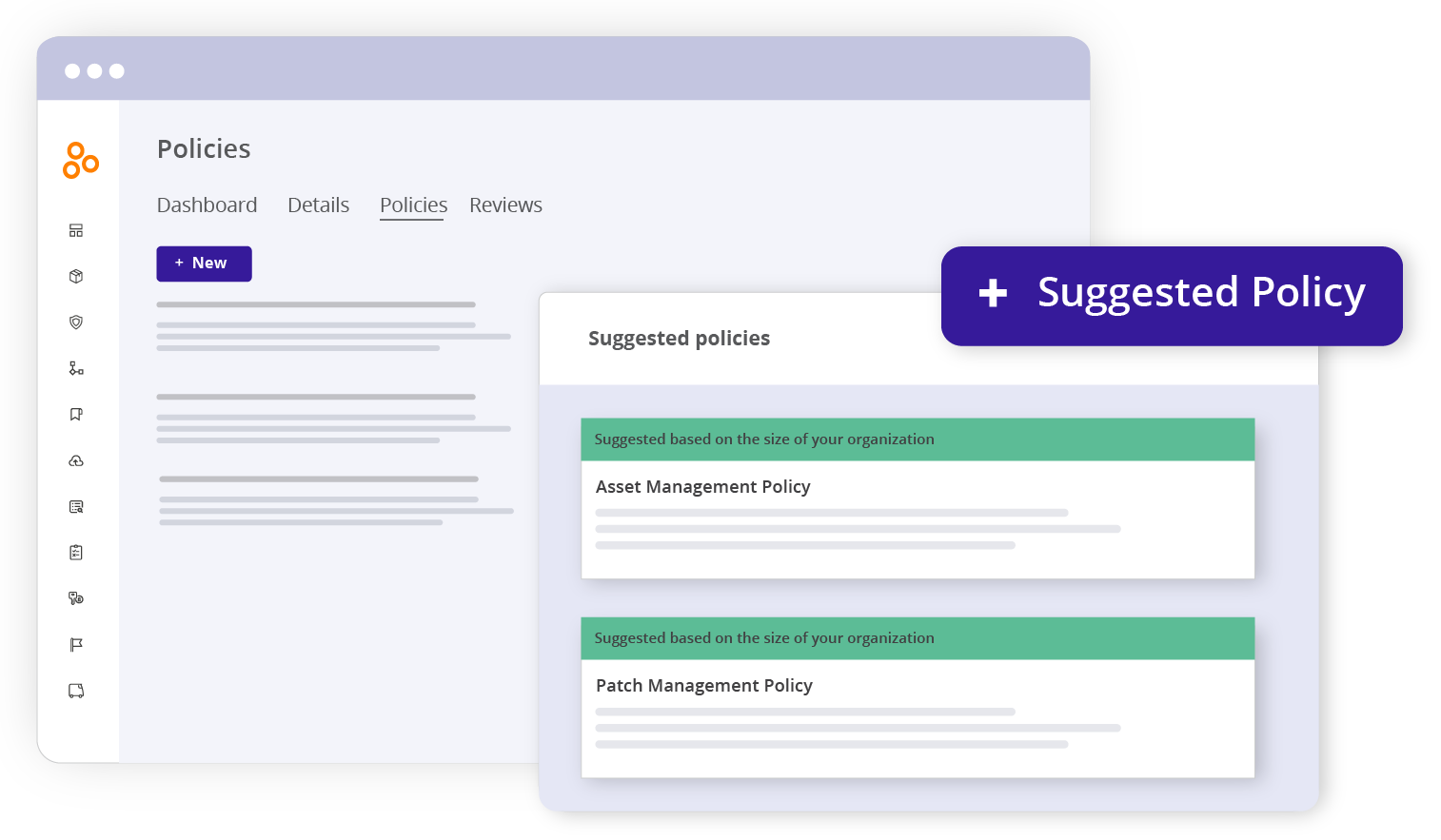

2. Keep privacy policies up-to-date

Your privacy policy is a living document that should evolve alongside your business practices. Hyperproof allows you to keep a record of your compliance efforts, so when it’s time to update your privacy policy, you have the information you need at your fingertips. Additionally, it can help you ensure that the policy remains aligned with legal requirements and is accessible to your stakeholders.

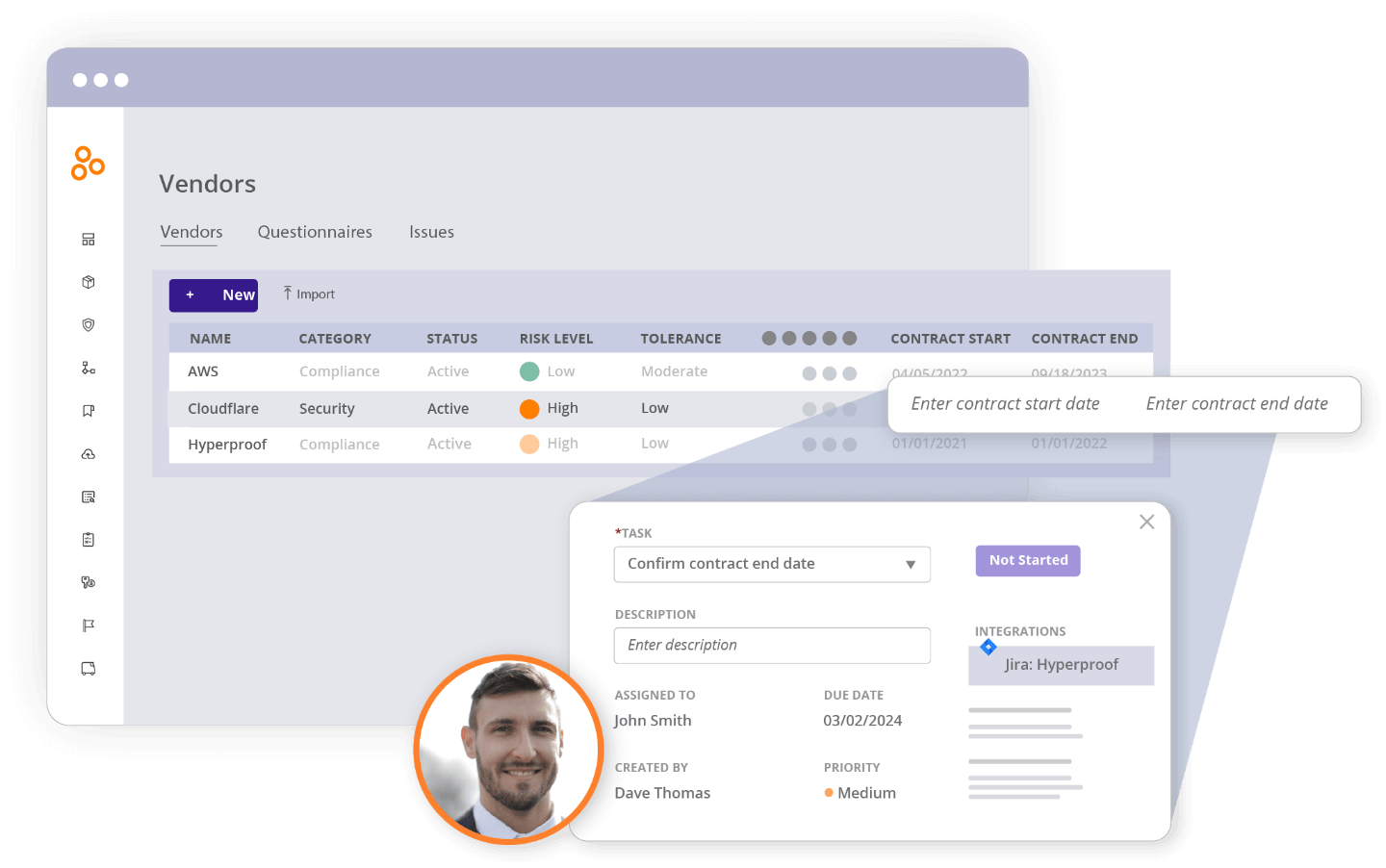

3. Centralize vendor oversight

Vendors and third-party providers often have access to your data, which means their compliance is your responsibility too. Hyperproof makes vendor management easier by allowing you to track contracts, compliance documentation, and risk assessments all in one place. This ensures that your vendors meet the same rigorous privacy standards you set for your own organization.

4. Proactive security monitoring

Under the CCPA, implementing “reasonable” security measures is a requirement, and Hyperproof can help you document and manage your security controls. By aligning your organization with recognized security frameworks (like NIST or ISO 27001), the platform helps you stay proactive about your cybersecurity posture. This not only helps with compliance but also reduces the risk of costly data breaches.

5. Demonstrate compliance with confidence

One of the biggest challenges in compliance is proving that you’ve done everything right. Hyperproof provides a centralized system of record to store all documentation related to your CCPA program—from data inventories to training records and vendor contracts. If regulators come knocking, you’ll be ready with clear, auditable evidence of your compliance efforts.

Beyond CCPA: preparing for CPRA

By using a compliance platform like Hyperproof to centralize and streamline your efforts, you can reduce the complexity of meeting CCPA requirements and build trust with your consumers. It’s a smarter way to stay compliant, protect your reputation, and maintain peace of mind.

The CCPA isn’t the end of the road for data privacy regulations. The CPRA expands on the CCPA, introducing concepts like “sensitive personal information” and enhanced rights for consumers. Staying informed about evolving laws ensures you remain compliant and competitive.

CCPA compliance may seem like a significant undertaking, but it’s a chance to future-proof your organization in an era where privacy expectations are only growing. By embracing transparency, empowering consumers, and safeguarding data, you not only meet legal requirements but also gain a competitive edge in your industry.

See Hyperproof in Action

Related Resources

Ready to see

Hyperproof in action?