Guide

How to Prioritize Implementing New Compliance Frameworks

Introduction

Expanding and scaling a company requires careful risk management and compliance planning, especially as you grow into new markets and increase operational complexity.

As your product lines and customer base grow, so will the number regulations you need to adhere to. At this stage in your growth, you’ll run into the inevitable: having to identify one or more compliance frameworks to implement to enable business expansion, unlock new markets, and grow your business.

Compliance frameworks provide structured approaches to managing and securing data, protecting a company’s IP, and maintaining user privacy in accordance with regulatory requirements. These frameworks help establish processes for data protection, risk assessment, and incident response.

In this comprehensive guide, we’ll cover:

This guide will help you holistically consider risk management and compliance and identify the next framework(s) your organization should implement, balancing risk and growth for your company’s expected trajectory.

The 7 dimensions of risk management and compliance

Growing and scaling a business requires strategic planning around managing risks and ensuring compliance. The following section outlines a structured approach to tackle these challenges from a compliance and cybersecurity viewpoint.

1. Regulatory compliance and governance

Data privacy regulations

As your business expands, you’ll likely deal with more personal data from customers or employees. Your growth makes compliance with data protection laws like the General Data Protection Regulation (GDPR) or the California Consumer Privacy Act (CCPA) crucial. Non-compliance can lead to significant fines and reputational damage. Growing companies need to:

Additionally, depending on your industry, you may need to comply with specific regulations like HIPAA for the healthcare industry, PCI-DSS for the payment card industry, or Sarbanes-Oxley (SOX) for financial reporting. Understanding the regulatory landscape in your target markets and building systems to monitor compliance is critical.

As you scale internationally, it’s crucial to understand local laws regarding data storage, intellectual property, and digital communications. Countries like the US, Canada, Australia, China, the United Kingdom, and Brazil all have laws governing how businesses must handle and secure residents’ data. Laws like DORA and NIS2 affect infrastructure providers operating in certain EU vertical markets. This may require expanding your compliance team or hiring regional experts.

2. Cybersecurity requirements

As you grow, you become a more attractive target for cybercriminals. A proactive cybersecurity approach includes:

3. Operational risks

As you scale and rely on more third-party vendors, you need a robust vendor risk management program that includes:

Scaling up can increase operational complexity, so a business continuity plan (BCP) is essential to ensure your company can continue operations during a crisis. A solid BCP includes:

4. Risk management processes

Once an organization has been operating for a few years and has established departments and teams, implement a comprehensive enterprise risk management (ERM) program to regularly assess strategic, financial, operational, and compliance risks. The program should:

While many risks can be mitigated through direct action, insurance should be essential to your risk exposure limitation plan. Cybersecurity insurance, errors and omissions (E&O) insurance, and directors and officers (D&O) insurance become critical as your exposure increases. Ensure you have coverage that aligns with your business risks, and regularly review policies as your operations grow.

5. Workforce compliance

As your team grows, especially internationally, compliance with labor laws becomes more complex. This includes managing employment contracts, benefits, and workplace safety. You may need HR compliance specialists to ensure adherence to local regulations.

Your employees can be a strength or a liability for risk management. Create and regularly update compliance and security awareness training to ensure they understand phishing attacks, social engineering tactics, and corporate policies on data handling.

6. Legal and intellectual property protections

As you scale, protecting your intellectual property (IP) becomes critical, especially when entering new markets. Work with legal teams to ensure patents, trademarks, and copyrights are in place. For foreign markets, work with experts to understand the varying legal frameworks for IP protection and enforcement across jurisdictions.

7. Financial and tax compliance

Expansion may introduce new tax liabilities, particularly in different states or countries. Consult with tax experts to ensure compliance with tax laws in all regions where you operate.

As your company scales, you may need to adhere to more stringent financial reporting standards, especially if you want to raise venture capital or prepare for a public offering. Implement systems to ensure accurate, timely financial reporting and consider third-party audits.

Adopting new compliance frameworks is necessary for market expansion

As organizations grow and enter new markets, adopting the right compliance frameworks becomes a strategic necessity rather than a regulatory checkbox. Each market brings unique compliance requirements, from data protection standards to financial and operational regulations.

These frameworks not only protect companies from legal risks but also build trust with new customers, partners, and stakeholders. For example, expansion into Canada requires compliance with the Personal Information Protection and Electronic Documents Act (PIPEDA), which outlines strict data handling and consent guidelines.

Similarly, suppose a fintech company aims to do business in Singapore. In that case, it must adhere to regulations from the Monetary Authority of Singapore (MAS), which oversees financial regulations and supervises a wide range of businesses and activities, focusing on the stability, transparency, and security of Singapore’s financial system. Businesses handling the personal data of Japanese citizens must follow the Act on the Protection of Personal Information (APPI), a comprehensive data protection law that emphasizes transparency, data security, and accountability in handling consumer information.

Adopting these frameworks early allows companies to establish their operations on a foundation of trust and regulatory compliance, reducing the friction often faced when entering new regions. A proactive compliance strategy signals prospective partners and customers that the company values security and operational transparency, accelerating adoption and acceptance in new markets and ensuring smoother global expansion with minimized risk.

Common compliance frameworks companies have adopted

When organizations adhere to multiple regulations, identifying key compliance frameworks helps streamline processes and reduce compliance burden. Compliance frameworks provide structured approaches to managing and securing data in accordance with regulatory requirements. These frameworks help organizations establish processes for data protection, risk assessment, and incident response.

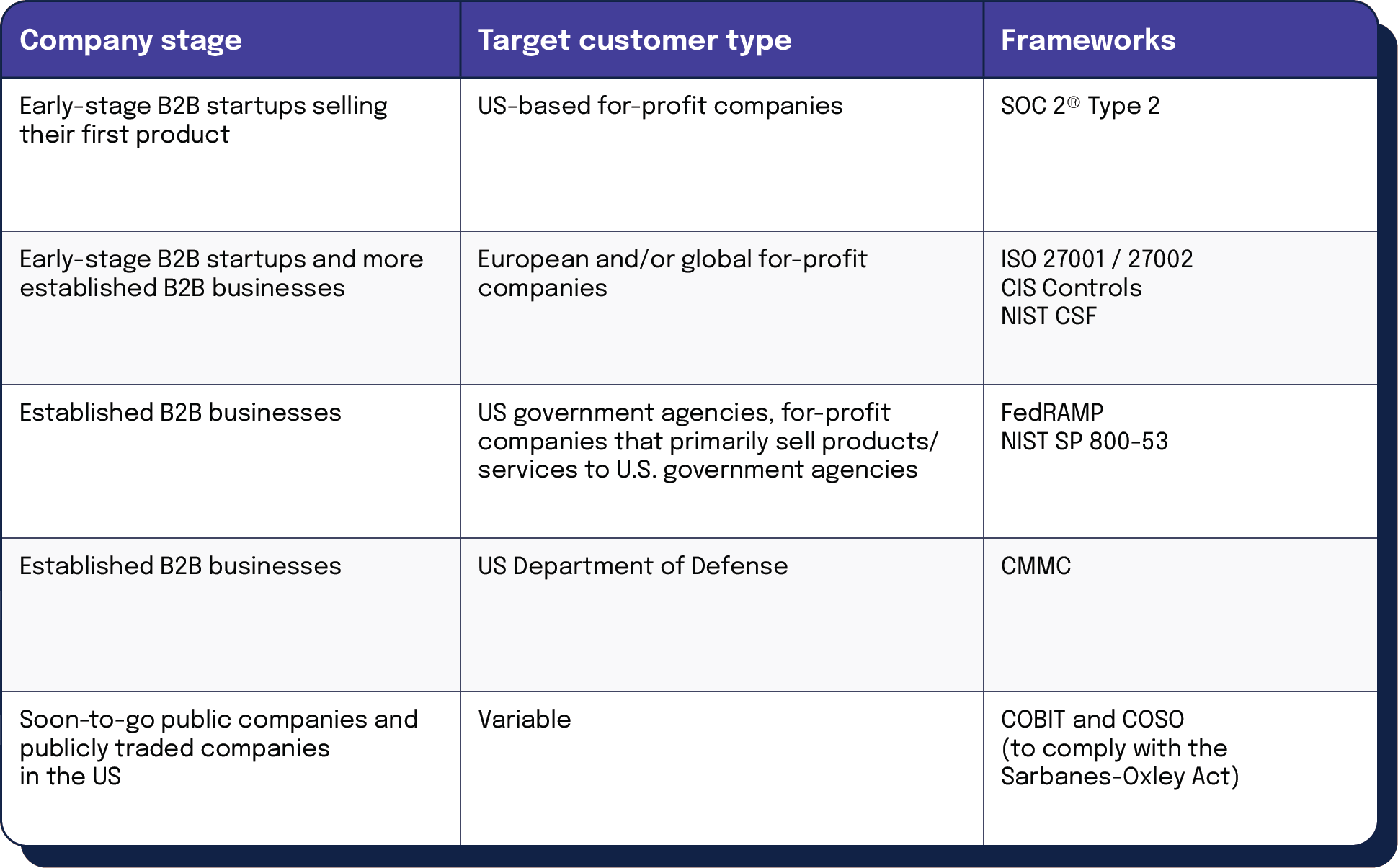

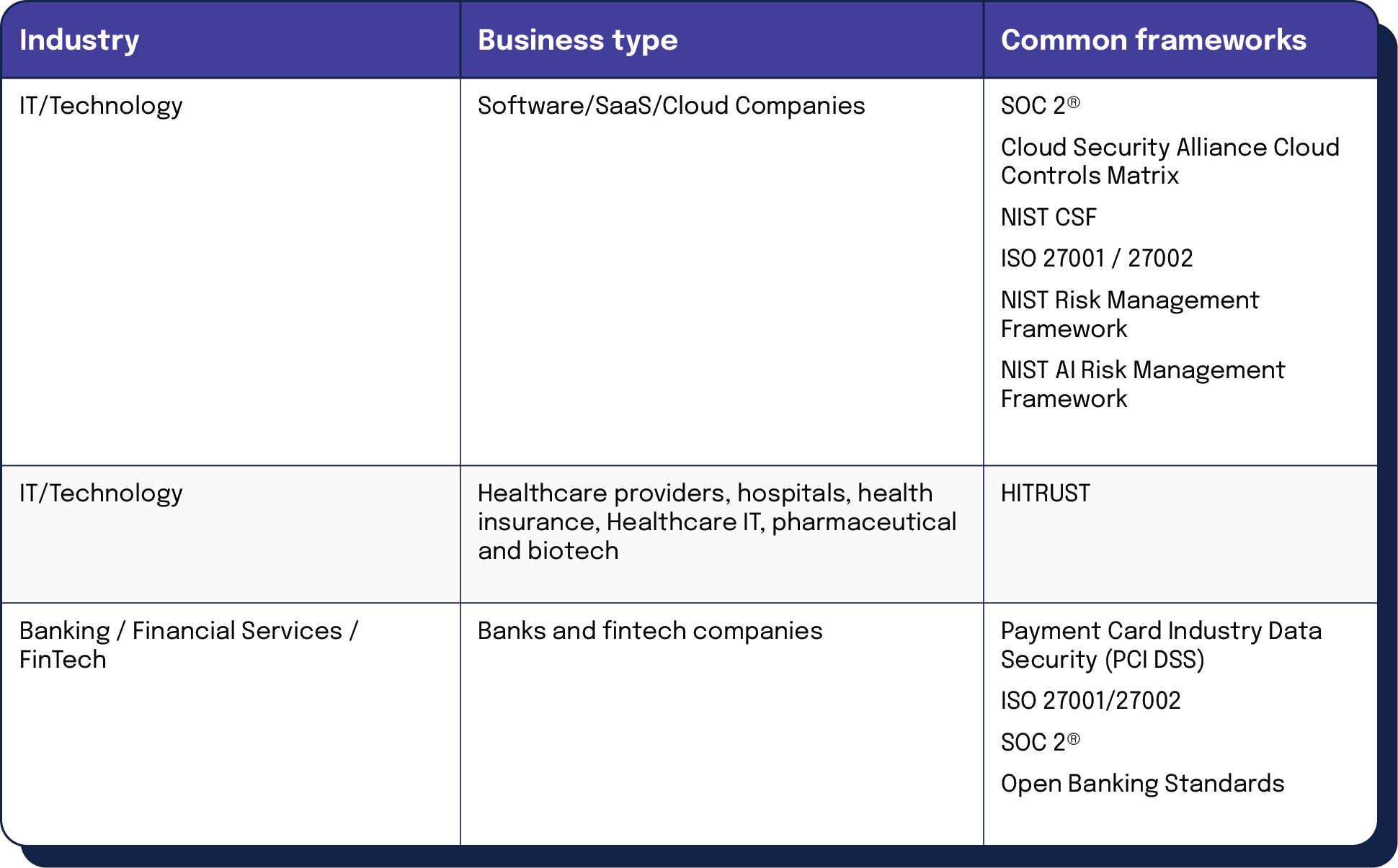

Most customer organizations we’ve worked with make compliance framework selections pragmatically based on their company stage, the requirements and expectations of their current and target customers, the operational complexity of their business, and the regulations and rules governing their industry. Below, we’ve published findings on the common frameworks companies have adopted.

Note: Regulations can change quickly, and every organization should consult with an attorney to ensure you are up-to-date with all applicable regulations. The data shown below is not legal advice but rather to help provide information about what peers in the US, Canada, and UK are doing.

By company stage and customer type

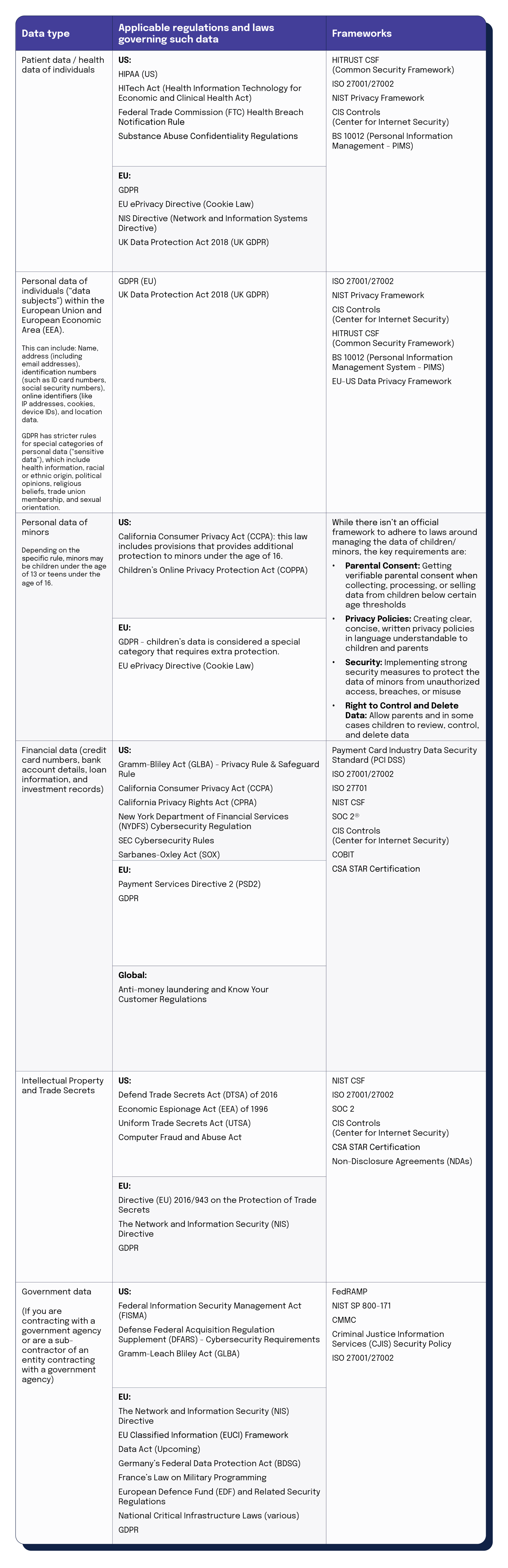

Data type and applicable data protection regulations

The types of data you store and process will drive your compliance roadmap. Below are the various “protected” data types regulated by multiple laws, standards, and frameworks.

By industry/business type

How to budget for new compliance frameworks

Implementing compliance frameworks requires both strategic planning and financial commitment. By setting realistic timelines and budgeting appropriately, compliance professionals can manage the costs and complexities of these frameworks while positioning their organizations for growth, market expansion, and successful audits.

Here’s a breakdown of what to expect regarding timelines, steps, and cost estimates for common frameworks.

SOC 2® Type 2

For companies aiming to achieve SOC 2® Type 2, the timeline generally ranges from four months to a year, depending on the organization’s maturity and preparedness. SOC 2 compliance requires establishing controls to meet the Trust Services Criteria, which include security, availability, processing integrity, confidentiality, and privacy.

The process begins with a gap analysis to identify existing controls and documentation deficiencies. Next, the organization must close control gaps and create any missing documentation. Following this, the controls must operate effectively for three to six months to ensure reliability before the audit. Securing an auditor and scheduling the audit is another key step that can take additional time. The audit itself may range from a few weeks to several months, depending on the organization’s size and complexity.

Estimated cost

SOC 2® audits typically cost between $15,000 and $60,000, depending on the organization’s size, maturity, and chosen audit provider.

ISO 27001 Certification

ISO 27001, a widely recognized information security standard, has a timeline that varies based on organization size and internal resources. Smaller companies may complete the certification process in under a year (or two to three quarters if they are quite mature), while larger organizations may need a year to a year and a half. To gain the ISO 27001 certification, your organization should already have staff with internal auditing expertise.

The process includes several key steps:

Estimated Cost

ISO 27001 certification can cost organizations between $15,000 and $100,000, depending on size, maturity, and the depth of pre-existing security measures. Costs include preparation (e.g., consultant fees paid for assistance with risk assessments, control selection, and policy creation), implementation (staff training and security tools), and certification audit costs.

FedRAMP Moderate

For organizations pursuing FedRAMP Moderate designation to bid on U.S. government contracts, the process is both rigorous and costly. On the low end, it takes 16 to 18 months minimum, extending to over two years for complex systems.

FedRAMP requires organizations to establish continuous monitoring systems, requiring around-the-clock staffing for system monitoring, log management, and threat response. This can involve hiring three shifts of staff solely for monitoring and incident response, representing a significant staffing commitment.

The process begins with a gap analysis to evaluate prior compliance experiences and define the authorization boundary. Organizations must then close any identified gaps and produce detailed compliance documentation, particularly the System Security Plan (SSP), which outlines precise operational procedures. The SSP must be kept updated as controls or systems change.

An agency sponsor is required, and securing one can be challenging. Different agencies, such as the Department of Defense (DoD) or the Department of Housing and Urban Development (HUD), may have varying processes and expectations.

After preparing the SSP and securing an agency sponsor, organizations must schedule an assessment from a FedRAMP Third Party Assessment Organization (3PAO). This evaluation is extensive; it includes vulnerability and penetration testing in addition to a thorough review of the SSP.

The 3PAO then sends assessment results to the sponsoring agency. Depending on the assessment results, the time it takes to receive an Authority to Operate (ATO) will vary.

Estimated cost

FedRAMP implementation will most likely exceed $1 million due to extensive control requirements, staffing needs, and audit costs. However, the return on investment can be substantial for organizations pursuing high-value government contracts.

CMMC 2.0 compliance

For DoD contractors, Cybersecurity Maturity Model Certification (CMMC) 2.0 will soon be essential. CMMC requirements are expected to take effect in mid-2025, but many DoD contracts already assume compliance with the DFARS clause. Organizations should implement necessary controls to meet the DFARS clause requirements stipulated by prior contracts.

Estimated cost

Costs can vary widely depending on the certification level required and the organization’s existing cybersecurity practices.

Here’s an overview of estimated costs for each level:

CMMC Level 1 (Foundational)

This level generally involves self-assessment and is the least expensive, typically around $4,000 to $6,000. These costs cover readiness assessments, minor technology investments, and self-assessment efforts for basic cyber hygiene, suitable for businesses handling Federal Contract Information (FCI) with limited security requirements.

CMMC Level 2 (Advanced)

This level targets companies handling Controlled Unclassified Information (CUI) and requires a third-party assessment. This level can be more involved, with estimated costs ranging from $20,000 to $60,000 for organizations that need minor technology upgrades and documentation work. For a full third-party assessment, however, costs can escalate to $102,000 for small companies and $112,000 for larger ones, including the triennial assessment and additional annual affirmations (Secureframe).

CMMC Level 3 (Expert)

This level is the most demanding, expected to cost more than one million dollars. This level involves advanced controls, extensive documentation, and readiness for sophisticated threat defenses against advanced persistent threats (APTs). The preparation includes significant cybersecurity infrastructure investments, like multi-factor authentication, endpoint protection, and continuous monitoring systems, and the assessment is often carried out by specialized government-led teams.

Additional preparation costs for gap assessments, CUI scoping, and risk assessments typically range from $15,000 to $50,000. Consultant fees vary based on the scope and the duration of engagement needed to meet CMMC requirements. Despite these costs, certification is essential for securing DoD contracts, with potential returns offsetting the investment.

Digital Operations Resilience Act (DORA)

The Digital Operations Resilience Act (DORA), effective January 2025, mandates resilience and data security measures for financial and information communication technology (ICT) providers operating in the European Union. Requirements include comprehensive ICT risk management, timely incident reporting, regular resilience testing (e.g., penetration and disaster recovery), and stringent third-party risk controls.

This legislation’s extraterritorial reach also requires non-EU ICT providers with critical roles in EU financial institutions to comply. For instance, B2B software companies doing business with EU financial institutions must create robust data protection programs and ensure regulatory compliance as an extension of contractual commitments.

For a company with solid foundational IT controls and risk management processes in place, preparing for DORA compliance would likely take six to 12 months, assuming foundational IT controls and risk management processes are already in place. DORA mandates additional requirements, such as advanced resilience testing, incident reporting frameworks, and stringent third-party risk management specific to the EU financial services sector. The timeline depends on the organization’s existing security controls, capabilities, and resources allocated for its compliance program.

Estimated cost

DORA is a new framework, so organizations are still in early stages of implementation and do not have a reliable cost estimate for implementation.

GDPR

GDPR applies to any company processing the personal data of EU residents, regardless of location. This includes AI companies with European users, as they process identifiable user data.

GDPR compliance generally takes between 6 months to 1 year for companies with mature data privacy practices, while others may need longer to establish compliance across key areas.

By setting realistic timelines and budgeting appropriately, compliance professionals can manage the costs and complexities of these frameworks while positioning their organizations for growth, market expansion, and successful audits.

Estimated cost

Costs typically range from $50,000 to $150,000 for initial setup, with recurring annual costs for data protection officers, compliance tools, and audits.

Other frameworks

Planning and budgeting for other compliance frameworks follows the same general pattern. Conduct a gap analysis between what’s required under the new compliance framework and what compliance frameworks and controls are currently operational at your organization. Based on the gap analysis, work with business owners to identify new controls and estimated costs (including staff and solutions, as appropriate). Additionally, work with the go-to-market team to set realistic schedule expectations about when the new framework will be implemented and referenceable in marketing materials and contracts. Once you have an agreed-upon plan to close the gaps, work to close those gaps and establish evidence of control operation proactively and automatically.

How to prioritize and decide which compliance framework(s) to implement next

To figure out the next compliance framework(s) your company needs, consider the following questions:

Questions to ask:

Talk to your business stakeholders, legal counsel, security team, IT, and engineering team to find the answers to the questions above.

For additional perspective, we recommend you talk to similarly situated companies and those you aspire to be like to learn how they approach this decision. Outside experts and advisors can also provide valuable insights.

Be realistic and honest about your company’s current state and where you’d like to be in the next 1-2 years. It’s not helpful to compare yourself to a company that is so much further ahead of you.

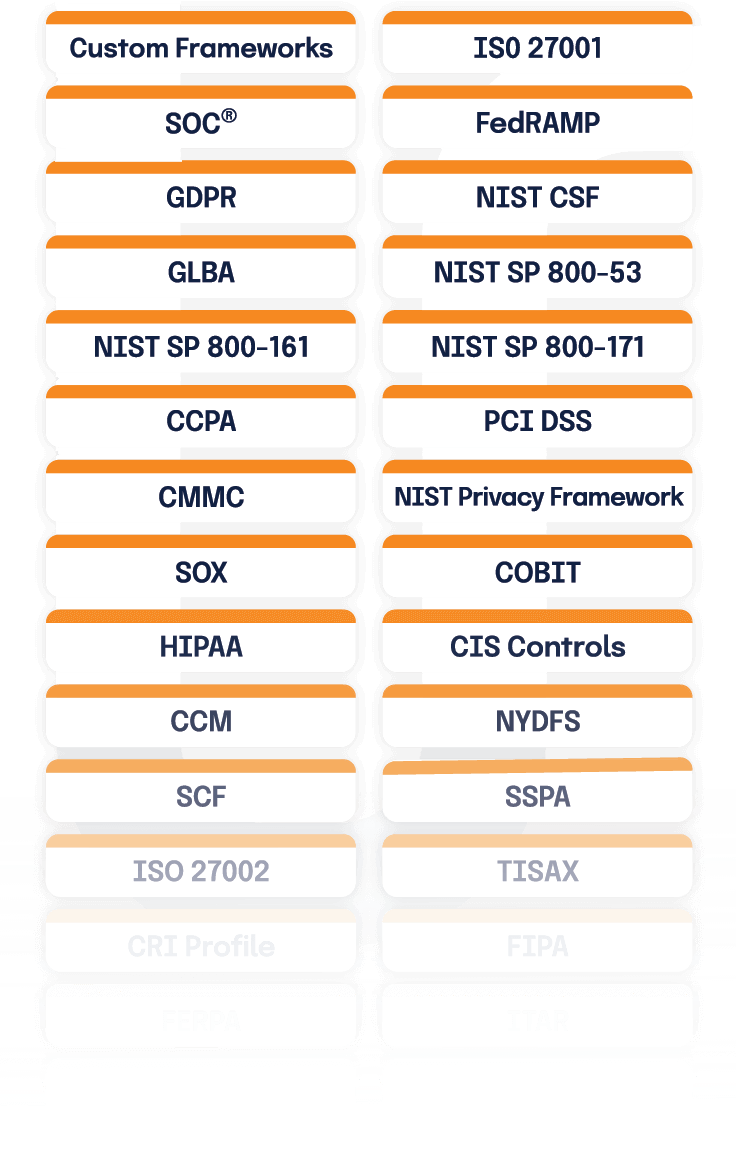

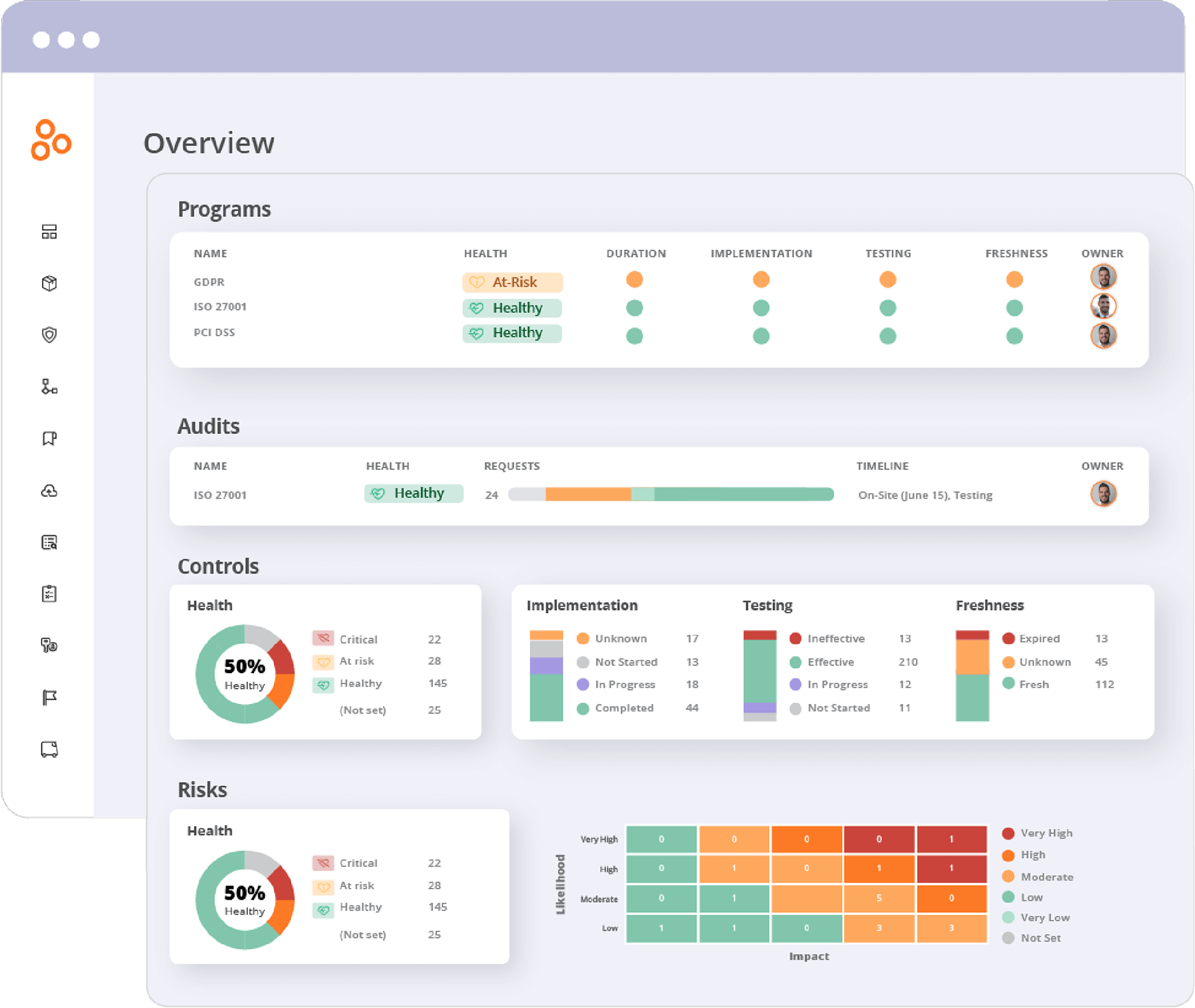

Reduce your compliance burden and manage multiple frameworks efficiently with Hyperproof

Hyperproof is an intuitive and powerful software platform that helps organizations of all sizes efficiently implement compliance frameworks. Organizations take advantage of our extensive library of compliance framework templates, automation, and integrations to easily implement new compliance frameworks, create standardized and unified compliance and risk management practices, and remain continuously compliant.

Download the PDF