Compliance Risk Assessments: 5 Essential Steps for Success

Editor’s note: This blog post is an excerpt from our ebook The 10 Key Elements of An Effective Compliance Program. You can download the entire ebook here.

Why it’s important to conduct compliance risk assessments

Compliance programs must be customized to the needs and challenges facing each company and be comprehensive enough to deal with all of the risks the company has identified.

The presence of an effective compliance program could mean more leniency from regulators in the event of a corporate misconduct investigation. In fact, in April 2019 and again in March 2023, the U.S. Department of Justice Criminal Division updated its guidance document for prosecutors on how to evaluate corporate compliance programs in the context of conducting corporate investigations. DOJ guidance states that prosecutors should consider whether the compliance program is appropriately “designed to detect the particular types of misconduct most likely to occur in a particular corporation’s line of business” and “complex regulatory environment.”

An effective risk assessment should begin with a detailed picture of the compliance landscape your company operates in. The two questions to answer are 1) where are you doing business, and 2) what regulations cover businesses like yours?

For example, are you trying to work with customers in healthcare? If so, you will need to make sure that your systems that handle patient data can sufficiently meet HIPAA security requirements. If you collect, store, transfer, or process the data of residents in the EU, you will need to comply with GDPR. If you regularly deal with third parties or suppliers and subcontractors, you will need to make sure these third parties have sufficient compliance programs of their own to address information security, privacy, and fraud risks.

The most important thing is this: your compliance efforts should be aimed squarely at the risks that are most critical to your business.

An effective compliance risk assessment must also include a clear picture of your organization’s operations. In other words, you need to know the “who, what, where, when, and how” of the day-to-day operations happening on the ground in your company.

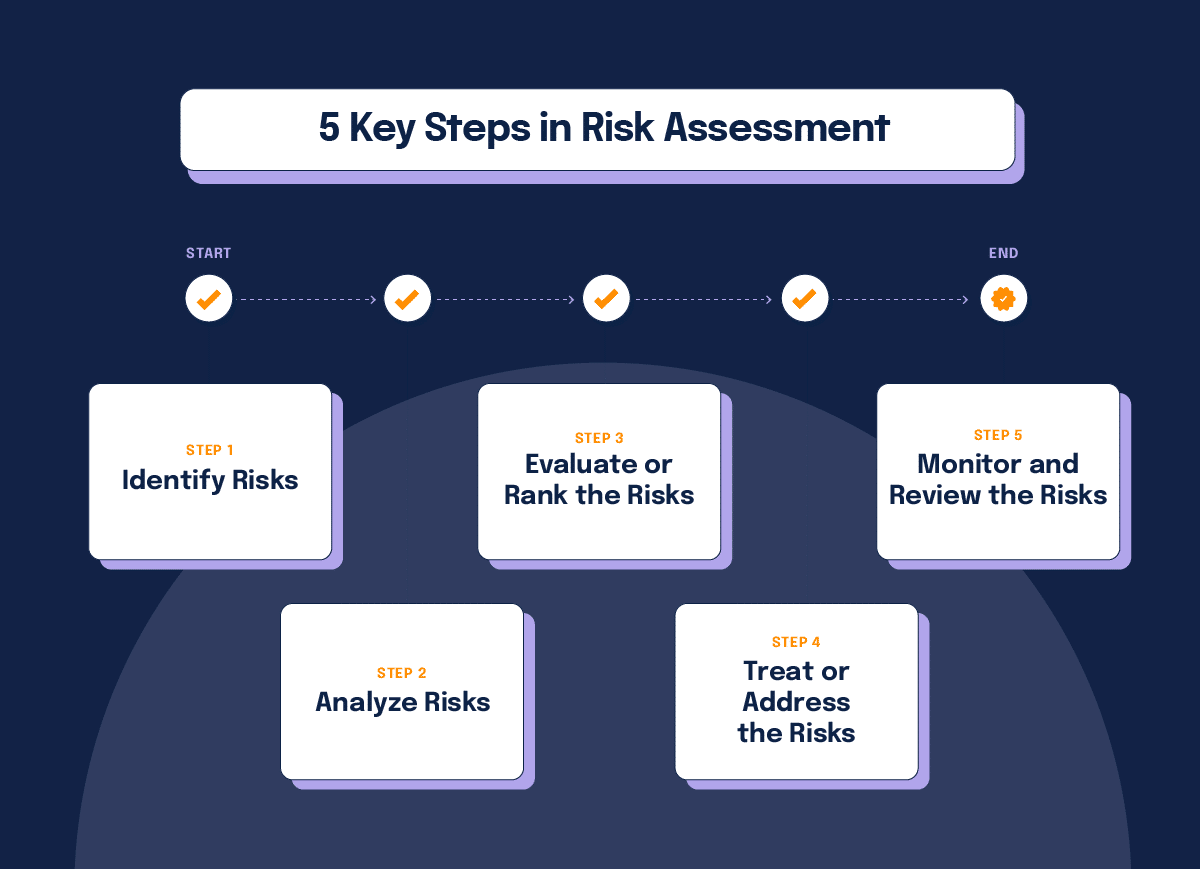

Key steps to compliance risk assessment

Step 1 – Understand the current state of affairs

Try to find what already exists. Learn about and document the key company processes, systems, and transactions. A dedicated compliance risk assessment tool can help you capture these processes consistently, standardize how risks are scored, and keep all your documentation in one place. It may be possible to find existing business process materials prepared for contract certification purposes. You also want to take the opportunity to meet key personnel who execute the business’s processes and systems. Interview these people and understand what motivates them and stresses them.

Step 2 – Map the potential risk contact points that exist in your company

Once you have a detailed picture of your company’s operations and the compliance landscape your company operates within, it’s time to identify the compliance risk contact points – the specific company operations that present the potential for violating applicable regulations. At this level, you’re answering, in concrete terms, “what is a compliance risk for our business?” Regular compliance risk assessments are just one crucial element of an effective compliance program.

You can identify these contact points by evaluating each of the key processes, systems, and recurring transactions identified in Step 1 in terms of questions or issues associated with the regulatory regimes you want to comply with. To keep these contact points organized and comparable across business units, many teams rely on a compliance risk assessment matrix to score likelihood and impact, assign owners, and link each risk to the controls designed to mitigate it.

For some organizations, this may also include a focused antitrust compliance risk assessment – for example, mapping where sales, pricing, or competitor communications could create anticompetitive concerns under competition laws.

Step 3 – Assess the current controls in place to prevent, detect, and correct violations

Are the existing procedures and controls at your company effectively addressing the risk contact points you identified? For each risk contact point, identify the specific policy, procedure, work instruction, or any other control that applies. You should assess the sufficiency of these controls in the context of your knowledge of each contact point. Over time, these reviews should become repeatable risk assessment procedures – consistent ways your team evaluates whether controls can reasonably prevent, detect, and correct violations.

Consider the likelihood that a violation will occur given a current control, whether such a violation would be detected, and, once detected, what the worst potential impact of the violation would be.

The contact points that are insufficiently addressed by current controls present compliance program gaps that need to be addressed.

Step 4 – Determine and prioritize the compliance enhancement measures you undertake

Your company probably won’t have the resources to tackle every compliance risk at once. You should rank your program’s gaps in terms of risk criticality and the resources required to remediate them. You’ll want to expend more resources policing high-risk areas than low-risk areas.

Once you’ve prioritized your company’s compliance opportunities, you should identify projects to address them systematically. Summarizing these priorities in a concise compliance risk report helps executives, auditors, and regulators understand why certain issues are being addressed first and how resources are being allocated. Identify the compliance enhancements that will generate the most benefits for your company.

Step 5 – Update your compliance risk assessment periodically

It’s important to note that a risk assessment shouldn’t be a one-off event. The DOJ’s guidance document for prosecutors states that as prosecutors evaluate the quality of a corporate compliance program, they should assess whether the company’s risk assessment is current and has been reviewed periodically.

Events such as the acquisition of new companies, movement into new geographical or sector markets, corporate reorganization, and engagement with new customers and regulators will raise different types of compliance risks. Similarly, regulatory changes and how enforcement authorities interpret these risks can create new compliance risks. It is important to implement a deliberate, recurring process to periodically update your risk assessment.

FAQ: compliance risk, defined

What is a compliance risk?

A compliance risk is the chance that your organization violates a law, regulation, or internal policy, leading to fines, investigations, operational disruption, or reputational harm. It’s the practical risk that your activities won’t align with the rules you’re expected to follow.

What is the meaning of risk compliance?

In everyday language, risk compliance means managing your exposure to legal and regulatory obligations in a structured way: identifying where you could break the rules, designing controls to prevent that, and testing those controls regularly with disciplined risk assessment procedures.

How does an antitrust compliance risk assessment fit into this?

An antitrust compliance risk assessment focuses specifically on competition and antitrust laws. It helps you identify high-risk activities such as pricing discussions, joint ventures, or sales practices that could be seen as anti-competitive, and then design policies, training, and controls to keep those behaviors within legal boundaries.

Regular compliance risk assessments are just one crucial element of an effective compliance program. A structured compliance program assessment connects those risk insights back to your overall program design, showing whether your policies, training, reporting channels, and monitoring activities truly align with your highest risks. To learn about the other program elements that are necessary for fostering a culture of ethical behavior and compliance, check out our ebook The 10 Key Elements of an Effective Compliance Program.

See Hyperproof in Action

Related Resources

Ready to see

Hyperproof in action?